Tejas Networks Limited which is tapping the capital markets with its simultaneous issue comprising of a fresh issue of Rs 450 crs and an offer for sale of 1.27 cr shares in a price band of Rs 250-257 completed allocation to anchor investors. The price band of the issue is Rs 250-257. The company allocated 1,35,99,600 equity shares at Rs 257 to 17 anchor investors comprising of 18 entities. The issue would garner approximately Rs 785 crs at the top end of the band. The issue comprises of 75% allocation to anchor investors, 15% to HNI’s and 10% to retail investors. The company is in the business of supplying and maintaining components in the telecom space which is currently seeing huge stress with the entry of Reliance Jio in the space. Balance sheets of various telecom providers are under stress and it’s become a tough market. Secondly the competitors for Tejas are MNC’s with deep pockets and significantly lower cost of manufacturing due to multi location and large scale operations. Thirdly the prospects of the IT industry and the IT services industry are currently under pressure and the industry is out of favour.

From an investor perspective the issue looks un-reasonably priced and expensive with the PE Ratio at a steep 26.60 times at the lower band and 27.34 times at the upper band. The benchmark indices currently trade around 21 times. Why an out of favour sector should quote at a premium baffles me.

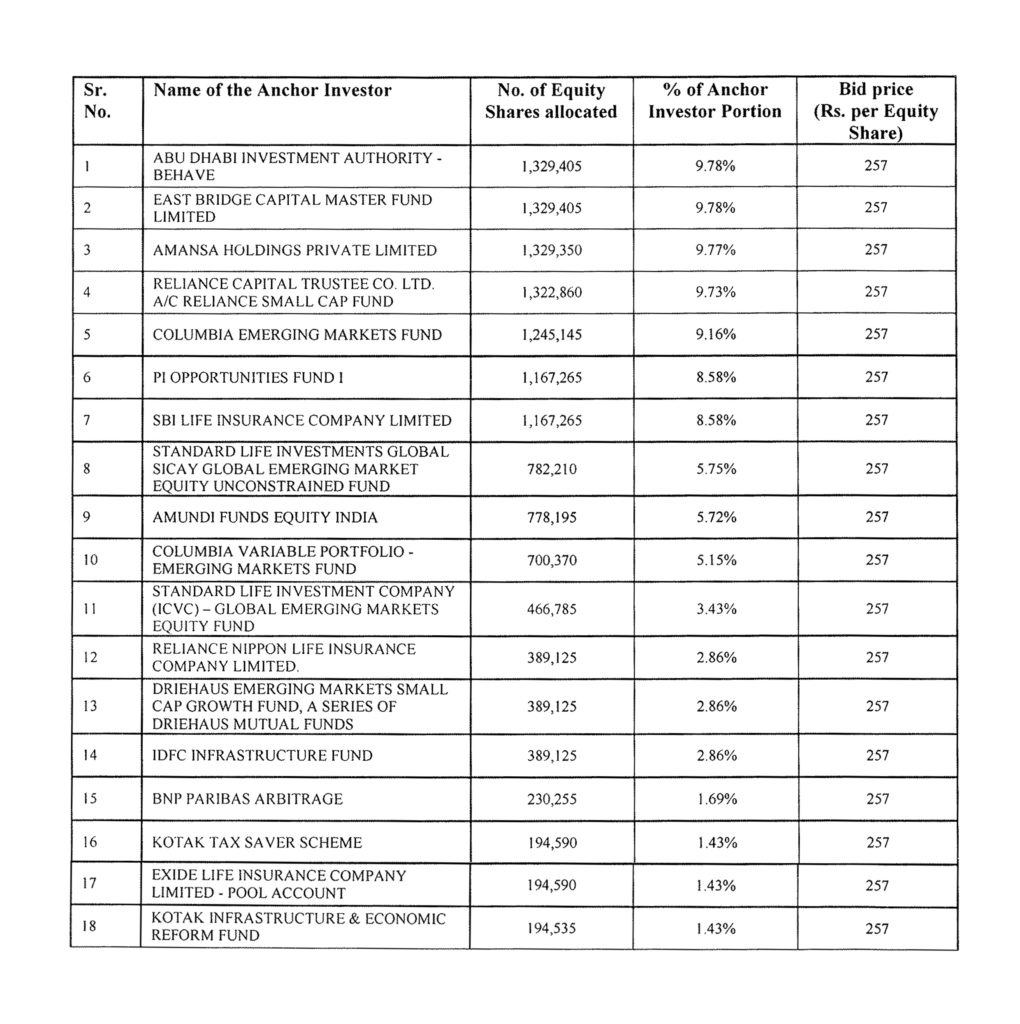

The full list of anchor investors and their allocation is given below:-

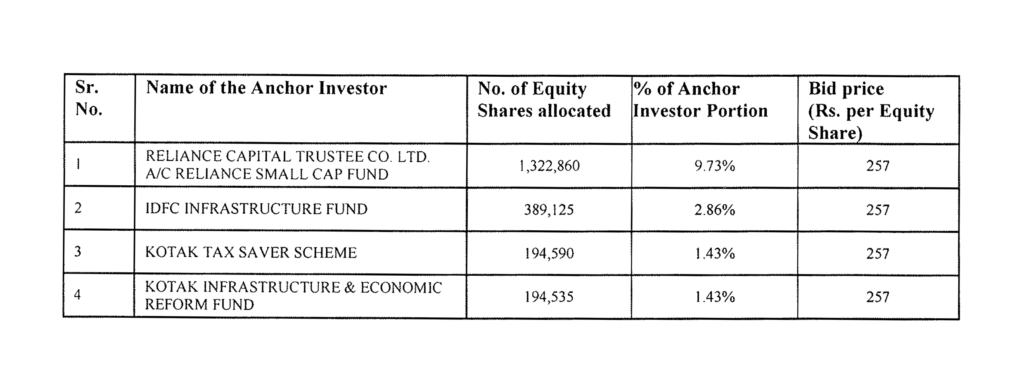

3 Mutual Funds have applied through a total of 4 schemes, scheme-wise details provided in the table below:-