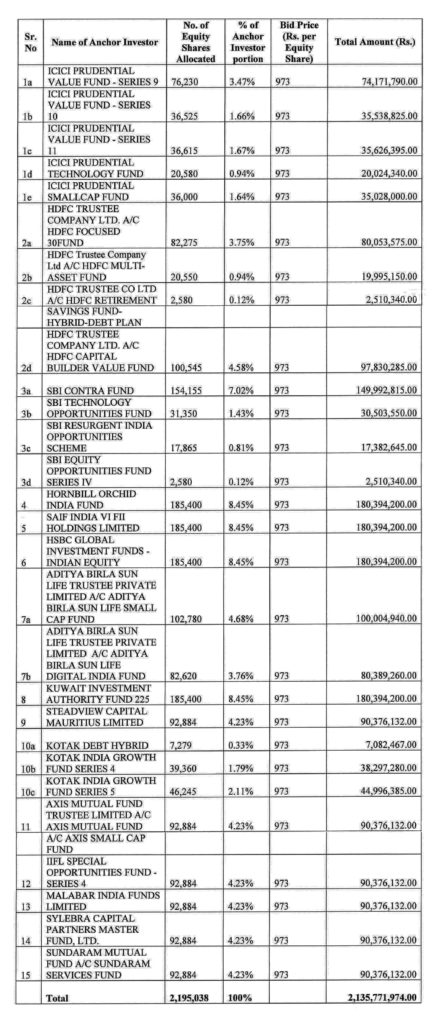

Indiamart Intermesh Limited (Indiamart) which is tapping the capital markets with its offer for sale of 48,87,862 equity shares completed allocation to anchor investors. The price band of the offer is Rs 970-973 and the company allotted 21,95,038 equity shares at Rs 973 to 15 anchor investors comprising of 28 entities. The highest allocation was made to three domestic mutual funds who were allotted an identical 2,05,950 equity shares or 9.38% of the anchor allocation. These three were ICICI, HDFC and SBI. The total allocation to domestic institutions was 49.29% while the balance was allotted to FII’s.

The issue opens on Monday the 24th of June and closes on Wednesday the 26th of June. The company is in the business of online B2B marketplace for business products and services. The revenue model is from subscription fee paid by sellers. The growth in revenue from paying subscribers is 19.68%. the total revenue was Rs 548.4 crs in the year ended March 2019. The company has deferred revenue of Rs 586 crs which is revenue received in advance from subscription This would typically get adjusted in 20 months. The EBITDA for March 2019 was Rs 82.3 crs. The company is debt free and has substantial cash holdings. The issue is likely to do well and would have listing gains. This incidentally would be the first IPO in Modi 2.0 regime.

The offer for sale would garner Rs 475 crs. The headline PE ratio is an unheard of 127.40 to 127.79 times. This is on account of the treatment of IND-AS accounting standard where there is a non-cash entry of Rs 65 crs on account of Compulsory Convertible Cumulative Preference shares (CCCP) which were converted in financial year 2019. If this item is reversed, then the PE becomes a much more respectable 32.8 times.

The full list of allocation to anchor investors with the number of shares allotted is given below: –