Affle (India) Limited which is tapping the capital markets with its simultaneous fresh issue and offer for sale, completed allocation to anchor investors. The company allotted 27,72,483 equity shares at the top end of the price band of Rs 740-745 to 15 anchor investors comprising of 28 entities.

The fresh issue is for Rs 90 crs and the offer for sale of 49,53,020 equity shares. The issue opens on Monday the 29th of July and closes on Wednesday the 31st of July.

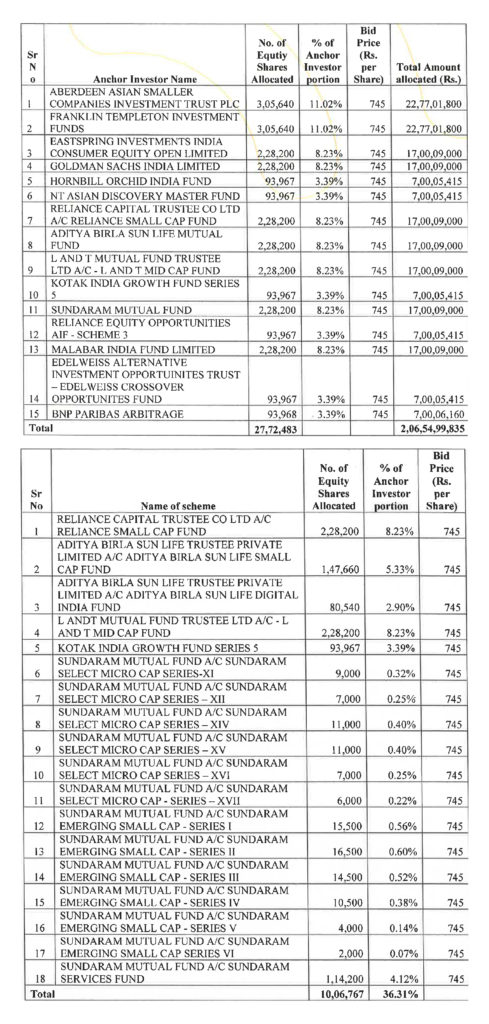

The largest allocation was made to Aberdeen and Franklin Templeton who were each allotted 3,05,640 shares or 11.02% of the anchor allocation. They were followed by seven investors who were allotted 2,28,200 shares or 8.23% and the last category of 6 investors were allotted 93,967 equity shares or 3.39% of the anchor book.

There is an existing investor in the company, Malabar India Fund who was allotted 2,28,200 shares.

The company is a global technology company and derives the largest part of its revenue from consumer platform. This platform provides new consumer conversions (acquisitions engagements and transactions) through relevant mobile advertising. It has in the last 12-18 months completed three acquisitions which would going forward result in margin expansion as the margins currently from these acquired businesses were lower compared to the parent’s core business. The issue is a Newgen business and is currently focused on the smart phone or hand held device.

The full list of anchor investors with their allocation is given below: –