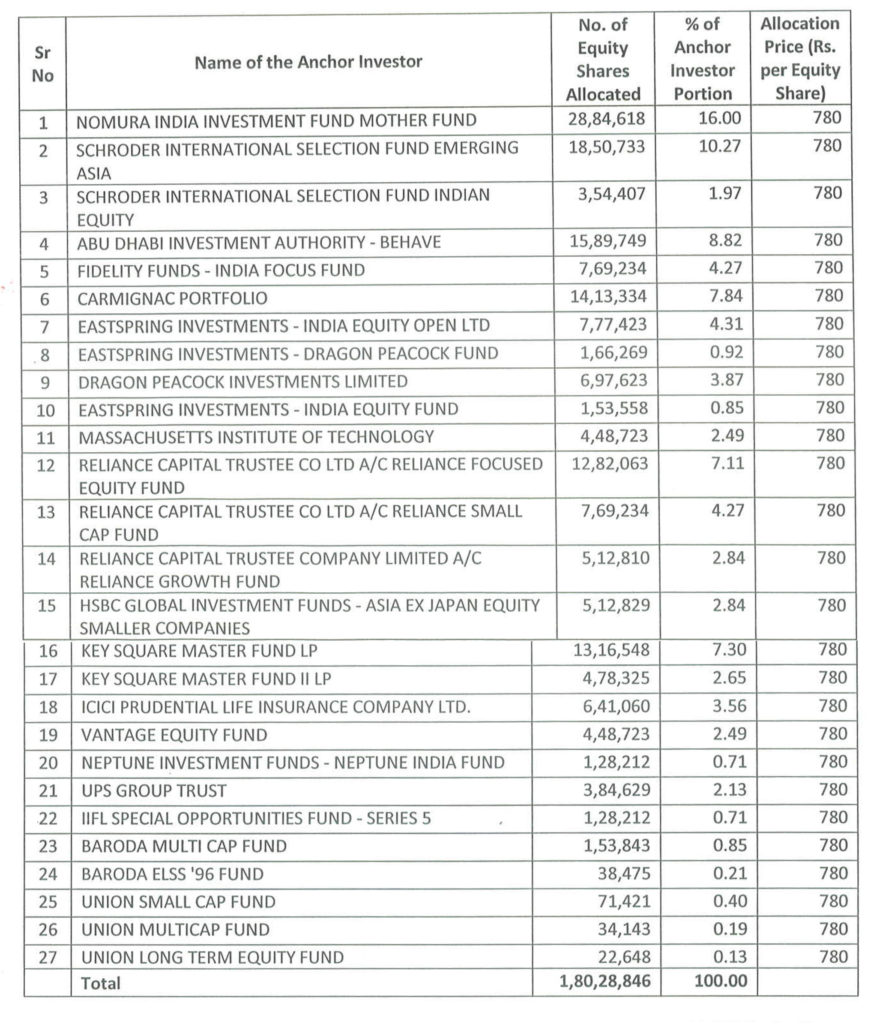

Sterling and Wilson Solar Limited which is tapping the capital markets with its offer for sale for Rs 3,150 crs completed allocation to anchor investors. The price band of the issue is Rs 775-780. The company allotted 1,80,28,846 equity shares to 21 anchor investors comprising of 27 entities.

The highest allocation was made to Nomura India Investment Fund Mother Fund who was allotted 28.84 lakh shares or 16% of the anchor book. This was followed by Reliance Capital Trustee Co Ltd who was allotted 25.64 lac shares or 14.22% in three funds. Indian funds were allotted 20.27% of the anchor book while Foreign funds were allotted 79.73% of the anchor book.

The issue has opened today i.e. Tuesday the 6th of August and would close on Thursday the 8th of August. The consolidated EPS is Rs 39.85 for the year ended March 2019 and the price earnings multiple is between 19.45-19.57. The company has completed the world’s largest single location plant in Abu Dhabi (UAE) of 1,177 MW. The future is solar and the way costs have come down and at the same time efficiencies on account of yield gone up, make this the future of energy.

It also appears that various multi-lateral agencies are looking for large solar projects on account of low cost of maintenance or virtually free of running costs. This also becomes an opportune way of containing emission in the ever-changing global warming that the world is currently facing.

Looking to the strong order book it would be reasonable to presume that the QIB portion of the book would receive strong support and demand.

The full list of anchor investors and their allocation is given below: –