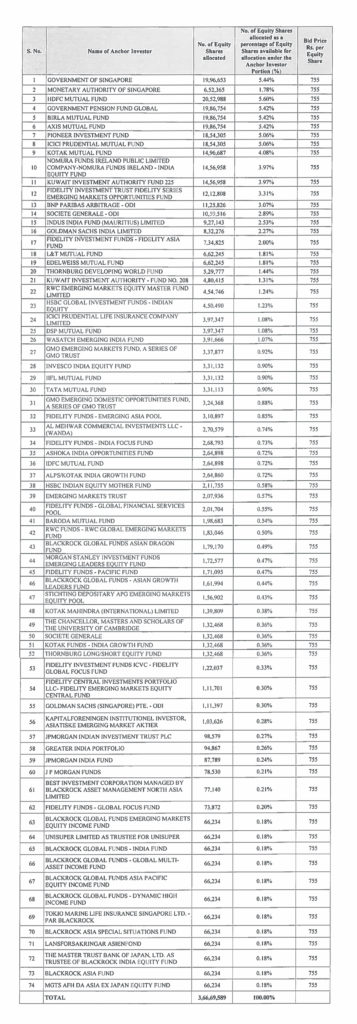

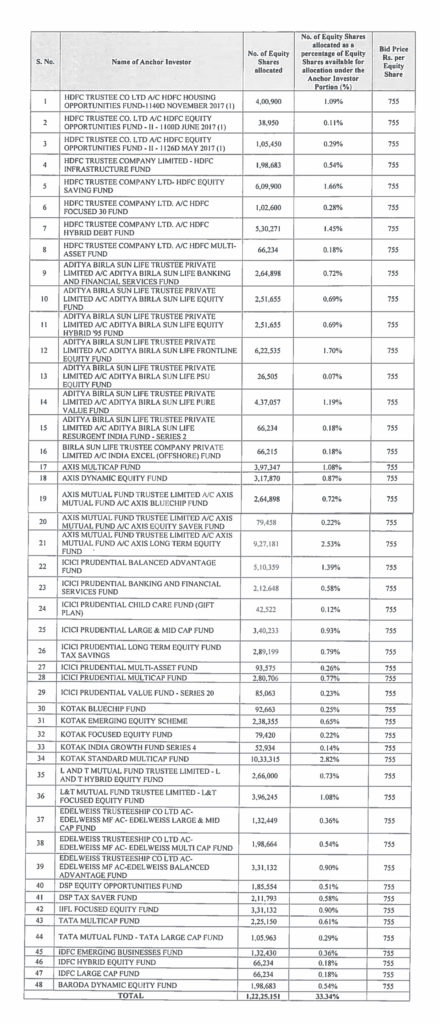

SBI Card and Payment Services Limited which is tapping the capital markets with its fresh issue of Rs 500 crs and an offer for sale of 13,05,26,798 equity shares completed allocation to anchor investors. The price band of the issue is Rs 750-755. The company allotted 3,66,69,589 equity shares to 74 anchor investors which included 12 mutual funds who have been allotted shares in 48 schemes.

The highest allocation has been made to HDFC Mutual Fund who has been allotted 20.53 lac shares. The top seven anchor investors have been allotted about 40% of the anchor book. This is an extremely fair and well distributed anchor allocation and is not skewed in any manner as has been seen in many other issues.

The issue opens on Monday the 2nd of March and closes on Wednesday the 3rf of March for QIB investors. It closes on Thursday the 4th of March for all other investors which include HNI’s, Retail, Employee and Shareholders.

The leveraged HNI has been allowed to bid in either the shareholder category or HNI category. The distortion in allocation of the shareholder category will be visible when allotment is made and almost the entire allocation would be made to a handful of shareholders. Hopefully after the same is visible the regulator and the promoter of the company would realise what they have allowed and been unfair to the large over 19 lac shareholders of the bank.

The full list of anchor investors with their allotment is given below: –