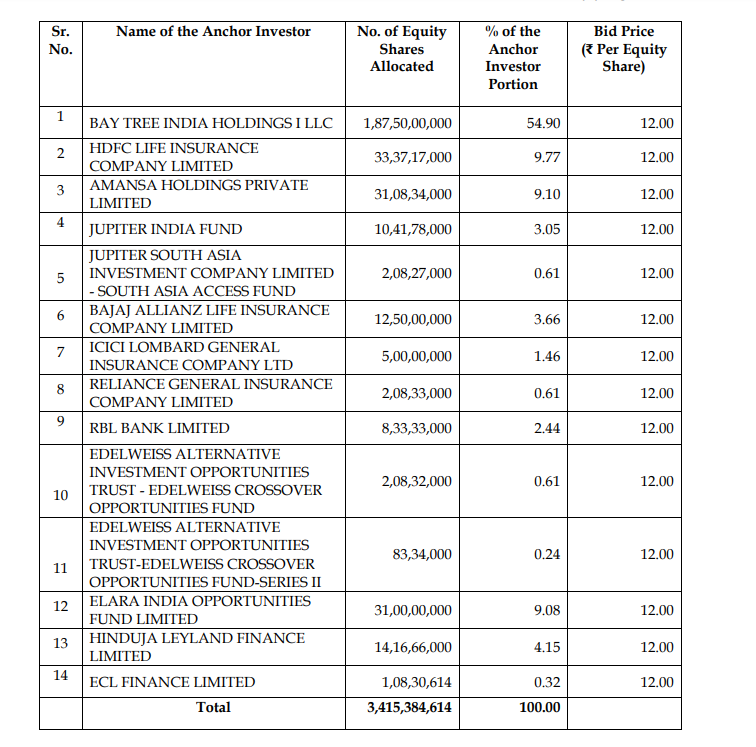

Yes Bank Limited which is tapping the capital markets with it follow on public offer to raise Rs 15,000 crs in a price band of Rs 12-13 completed allocation to anchor investors. The company allotted 341,53,84,614 equity shares (341.53 cr) to 14 anchor investors. The largest allotment is to Bay Tree India Holdings I LLC who was allotted 187.50 cr shares or 54.90% of the total anchor book. The other investors include HDFC Life, Amansa Holdings and Elara India opportunities fund who were allotted over 9% each. There is no allotment to SBI or domestic mutual funds.

Considering the fact that Tilden Park a marquee investor from the USA has invested a large chunk through Bay Tree and this becomes their first investment in India, it would be fair to assume that their investment is a long term investment and they would play an active role in the company going forward. Secondly it would also be fair to assume that the issue price band of Rs 12-13 would see the company allotting shares to all investors at Rs 12.

The issued capital of Yes Bank is 1255.047 cr shares of Rs 2 each. The fresh issue would double the equity to 2505.047 cr shares. SBI holds 605 cr shares in Yes Bank’s equity and has a commitment to continue to hold a minimum of 26% over the next three years. Post the dilution through FPO, SBI would have to hold a minimum of 651.31 cr shares or a fresh investment of 46.31 cr shares. It has committed to invest RS 1,750 crs in the FPO. The size of the FPO in the QIB category balance of the anchor allotment is Rs 3,000 crs. Considering SBI, this means there is a total of Rs 1,250 crs available or the QIB would be oversubscribed.

There is certainly going to eb interesting times for this issuer going forward.

The full list of anchor allotment is given below: –