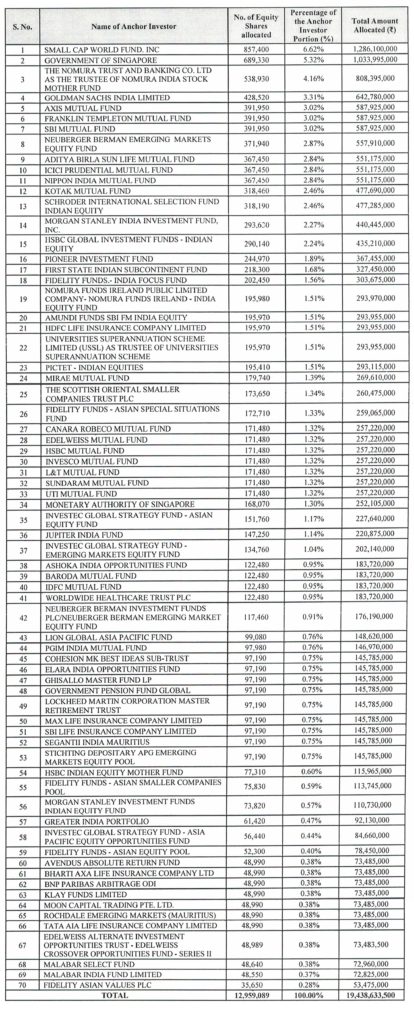

Gland Pharma Limited which is tapping the capital markets with its simultaneous fresh issue and offer for sale completed allocation to anchor investors. The company allotted 1,29,59,089 shares to 70 anchor investors comprising of 131 entities. The highest allocation was made to Smallcap World Fund who was allotted 8,57,400 shares or 6.62% of the anchor allotment. This was followed by 6,84,300 shares or 5.32% to Government of Singapore.

The issue comprises of a fresh component of Rs 1,250 crs and an offer for sale of 3,48,63,635 shares in a price band of Rs 1,490 to Rs 1,500. The issue opens on Monday the 9th of November and closes on Wednesday the 11th of November.

The revenue of the company has risen from Rs 1,622 crs in financial year ending March 2018 to Rs 2,633 crs in March 2020. The net margins have moved from 27.23% to 29.34%. The EPS for the year ended March 2020 was Rs 49.88 which has more than doubled from Rs 20.72 in March 2018. The PE multiple at which the shares are being offered is 29.87-30.07. While the PE multiple seems in line with the top pharma companies, the market cap to sales is one of concern where it is close to double digits.

The company is primarily into injectables and is a B to B player and does contract manufacturing for pharma companies with more than 2/3rd of its sales coming from the USA. The company is owned by Fosun Singapore and is a part of the Chinese conglomerate.

The Enforcement Directorate has attached 60 lac shares or 3.87% of the pre-IPO equity belonging to the Ramalinga Raju group, erstwhile promoters of Satyam Computers. This lot of shares valued at Rs 900 crs at the top end of the price band could be encashed by the directorate post listing. There is no lock-in for these shares and special permission was obtained from SEBI for the same.

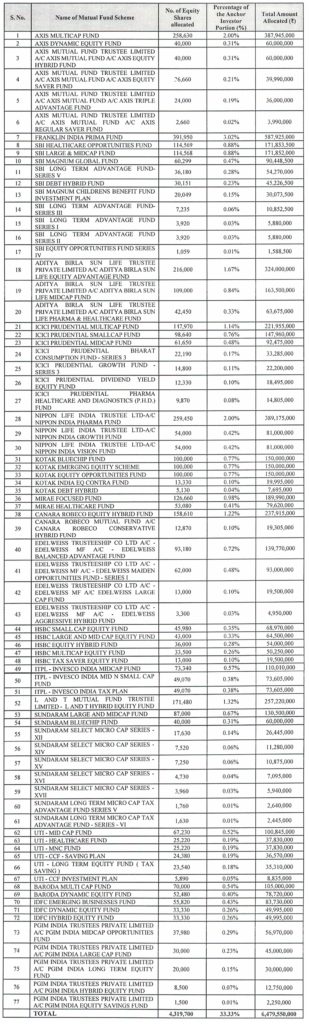

The full list of anchor investors with their allotment is given below: –