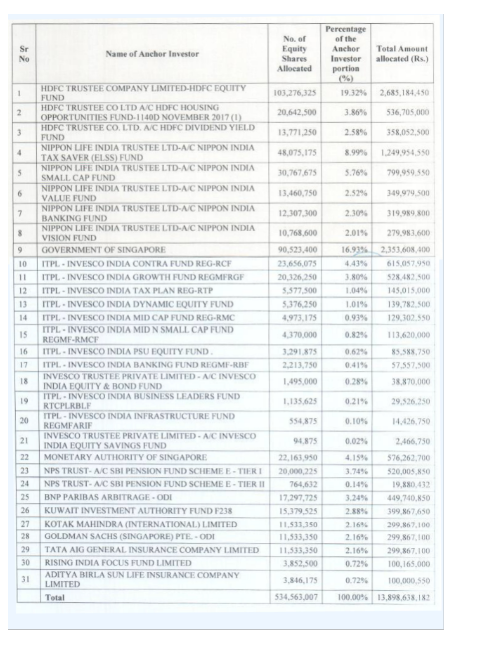

Indian Railway Finance Corporation Limited or IRFC which is tapping the capital markets with its fresh issue of 118,80,46,000 equity shares and an offer for sale of 59,40,23,000 in a price band of Rs 25-26, completed allocation to anchor investors. The company allotted 53,45,63,007 equity shares to 17 investors comprising 31 entities. The highest allocation of 25.76% or 13.76 cr shares has been made to HDFC equity fund through 3 entities. This is followed by an allotment of 21.58% to Nippon India mutual fund who has subscribed through 5 funds. Government of Singapore comes next with an investment of 16.93% and an additional 4.15% taken by Monetary Fund of Singapore. Invesco is yet another fund who has picked up a reasonable stake of 13.67%, investing through as many as 12 funds.

The government issues never had an anchor allotment and this issue would be setting a new trend in the PSU issues. Looking at the business of the company and the anchors, it appears certain that the investors are looking for a steady state of returns and as a bonus on that, capital appreciation. Investors too, should take a cue from the same and invest accordingly.

The issue opens on Monday the 18th of January and closes on Wednesday the 20th of January.

The full list of anchor investors is given below: –