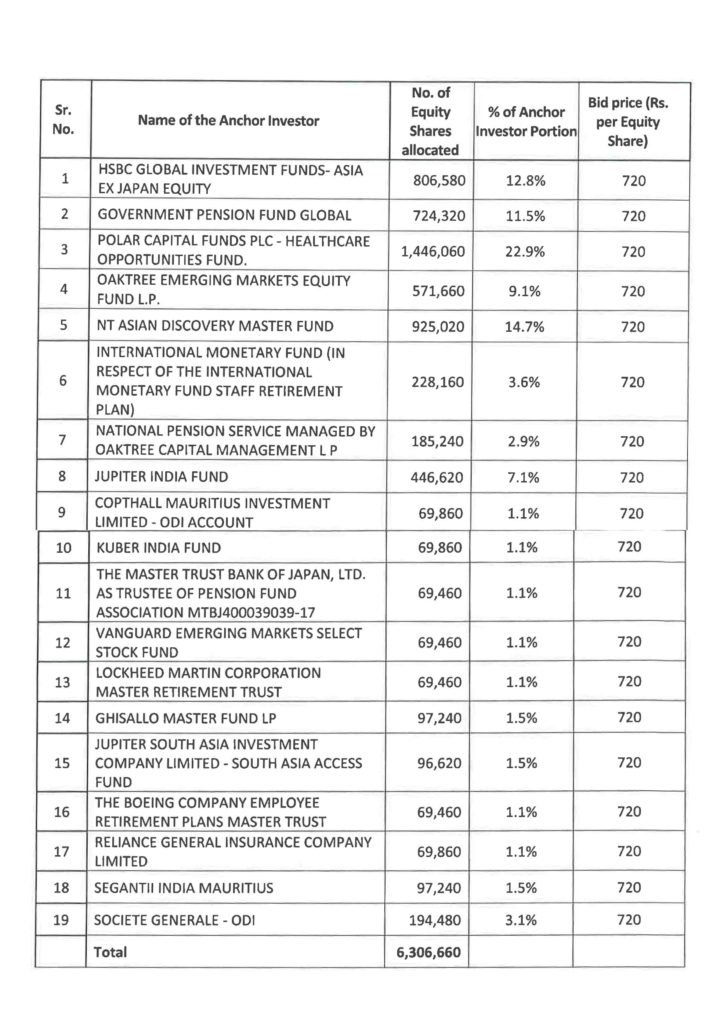

Glenmark Life Sciences Limited which is tapping the capital markets with its fresh issue for Rs 1,060 crs and an offer for sale of 63 lac shares in a price band of Rs 695-720, completed allocation to anchor investors. The company on Monday had allotted 63,06,660 shares to 19 anchor investors at the top end of the price band. The issue has opened on Tuesday the 27th of July and would close on Thursday the 29th of July.

The highest allocation was to Polar Capital Fund who was allotted 14,46,060 shares or 22.1% of the anchor book. This was followed by NT Asian Discovery Master Fund who was allotted 9,25,020 shares or 14.7% and HSBC Global Investment Fund who was allotted 8,06,580 equity shares or 12.8%. The top four anchor investors have been allotted 61.9% of the anchor book. At the bottom end, 7 funds have each been allotted 1.1% of the anchor book, indicating strong demand for the issue.

While domestic mutual funds are missing from the list, it appears that they chose to opt out on reasons of pricing. This seems odd when the difference in the top and bottom of the price band (720-695) is Rs 25 and is just 3.5% of the price. When every issue listing at the bourses records gains of 30% plus on day one why this is a concern? Strange are the ways of mutual funds.

Full details of the anchor allotment is given below: –