Metro Brands Limited which is tapping the capital markets with its fresh issue for Rs 295 crs and an offer for sale of 2,14,50,100 shares in a price band of Rs 485-500 completed allocation to anchor investors. The issue has opened on Friday the 10th of December and would close on Tuesday the 14th of December.

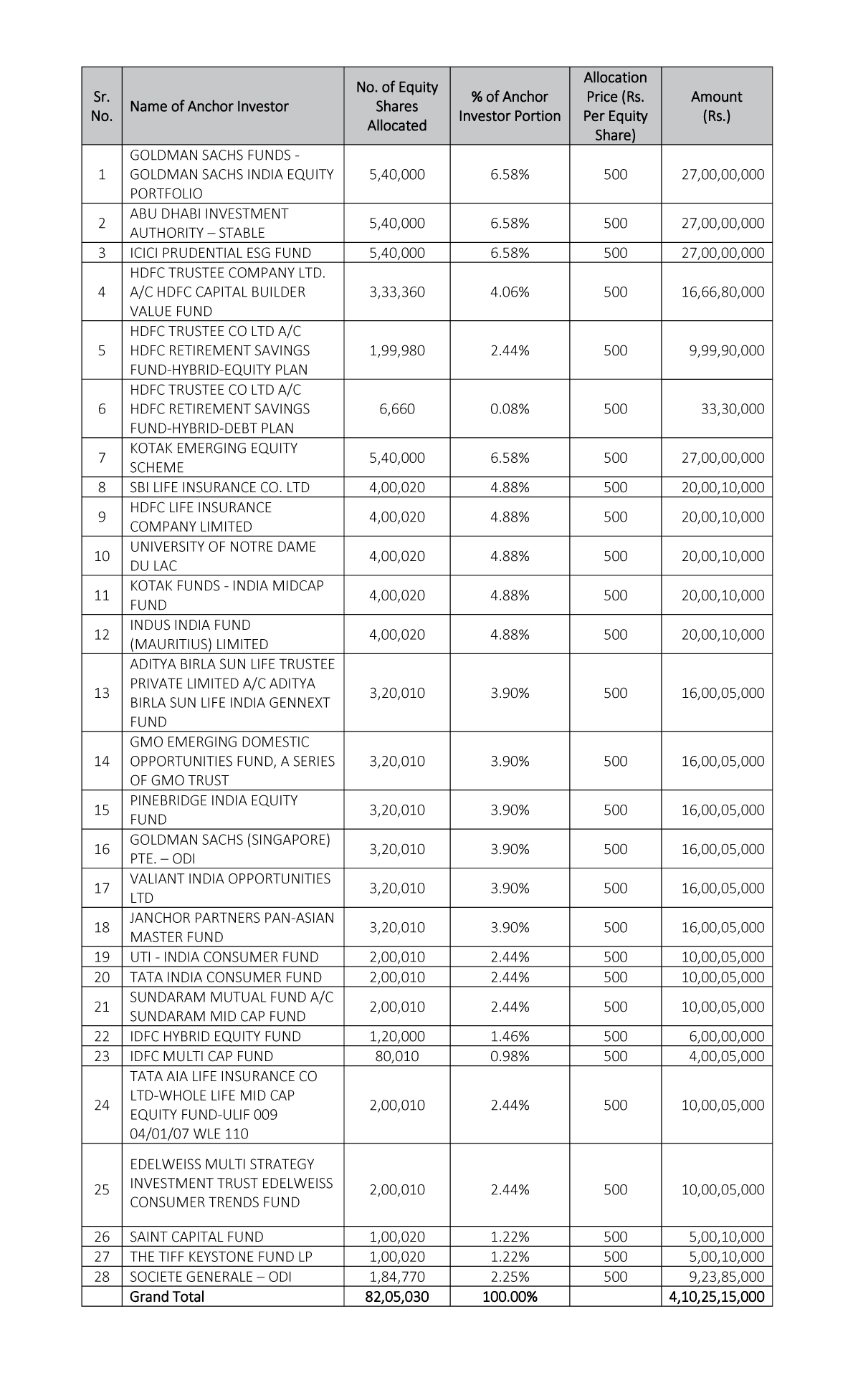

The company completed allocation to anchor investors by allotting 82,05,030 shares to 21 anchor investors comprising of 28 entities. Five anchors were each allotted 5,40,000 shares or 6.58% of the allocation. They were ICICI Prudential ESG Fund, Goldman Sachs, HDFC, Kotak and Abu Dhabi Investment Authority. This was followed by five entities being allotted 4,00,020 shares or 4.88% of the anchor book. The top ten anchors were allotted 57.30% of the anchor book.

Nine Domestic Funds comprising of 11 entities were allotted 27,40,050 equity shares or 33.39% of the anchor book.

Full details of the anchor allocation are given below: –