Adani Wilmar Limited who is tapping the capital markets with its fresh issue of Rs 3,600 crs, completed allocation to anchor investors. The company allotted 4,08,65,217 shares at the top end of the price band of Rs 230 to 11 anchor investors comprising of 15 entities. The price band is Rs 218-230 and the issue opens on Thursday the 27th of January and closes on Monday the 31st of January.

The highest allocation was made to the Government of Singapore was allotted 1,60,27,180 shares or 39.22% of the anchor book. Its associate, the Monetary Authority of Singapore was allotted 35,38,015 shares or 8.66% of the anchor book. Together, the two entities were allotted 1,95,65,095 shares or 47.88% of the anchor book. This kind of allotment is unparallel in recent times and speaks volumes of the comfort that the Singapore government has in its company Wilmar International owns an equal share in the company that Adani owns in Adani Wilmar Limited.

This was followed by four entities being allotted an identical 32,60,855 shares or 7.98% of the anchor book. These entities were Nippon mutual fund, Jupiter India Fund, Winro Commercial (India) Limited, and Dovetail India Fund Class 6 shares. This was followed by HDFC Mutual fund who was allotted 7.45% of the anchor book.

Three domestic funds were allotted 16.81% of the anchor book. The top six anchor investors were allotted 87.25% of the anchor book. It is a very concentrated anchor book and considering the size did not allow any leeway to funds to bargain.

The commitment from Singapore government sealed the issue for the company and saw its anchor issue raising just under Rs 940 crs quite easily. Whether this anchor would enthuse investors or make them complacent only time will tell.

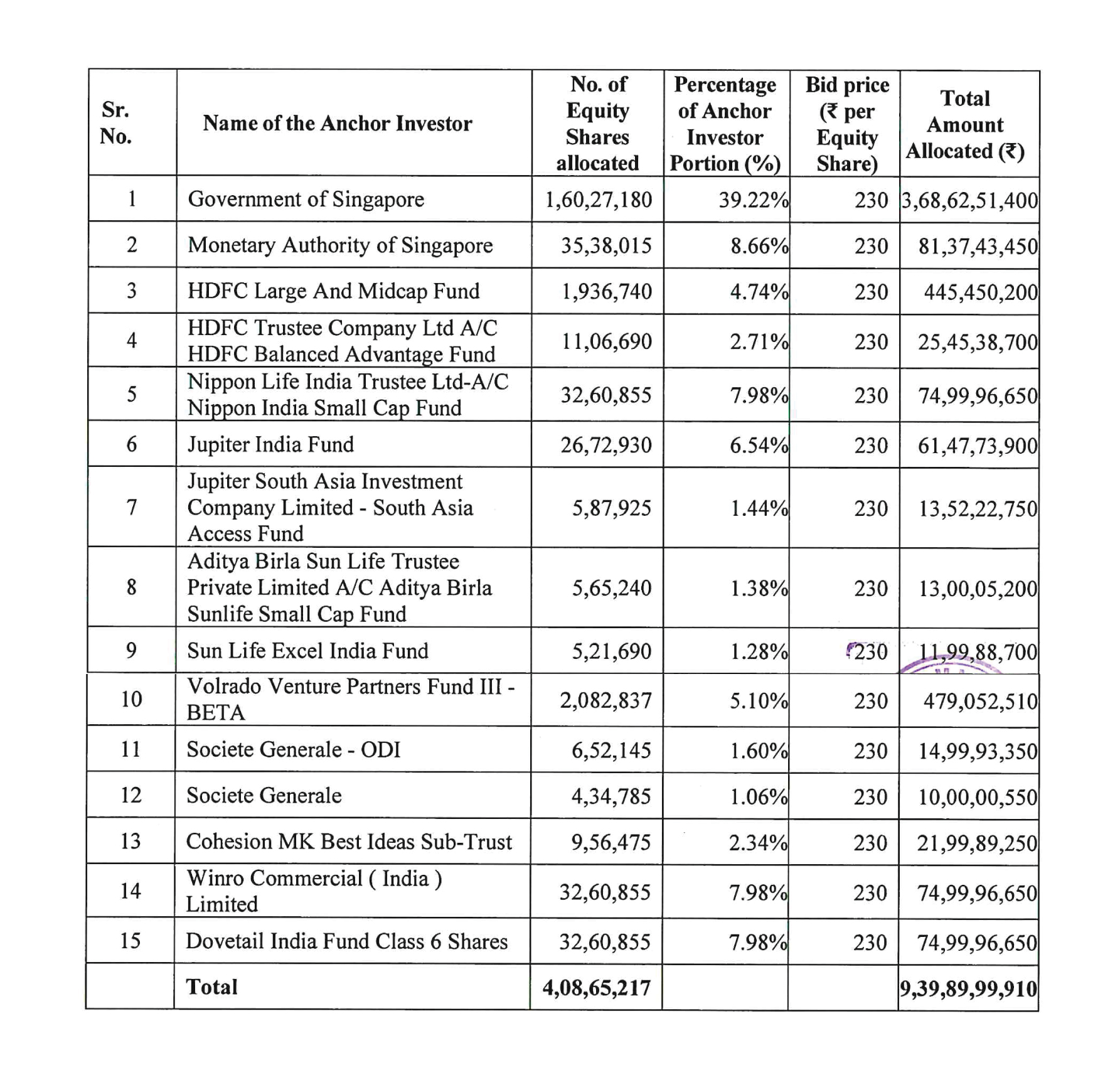

Full details of the anchor investors with their allotment are given below: –