Sandhar Technologies Limited which is tapping the capital markets with its simultaneous offer completed allocation to anchor investors. The company is issuing fresh shares worth Rs 300 crs and an offer for sale of 64 lakh shares in a price band of Rs 327-332. The issue opens on Monday the 19th of March and closes on Wednesday the 21st of March.

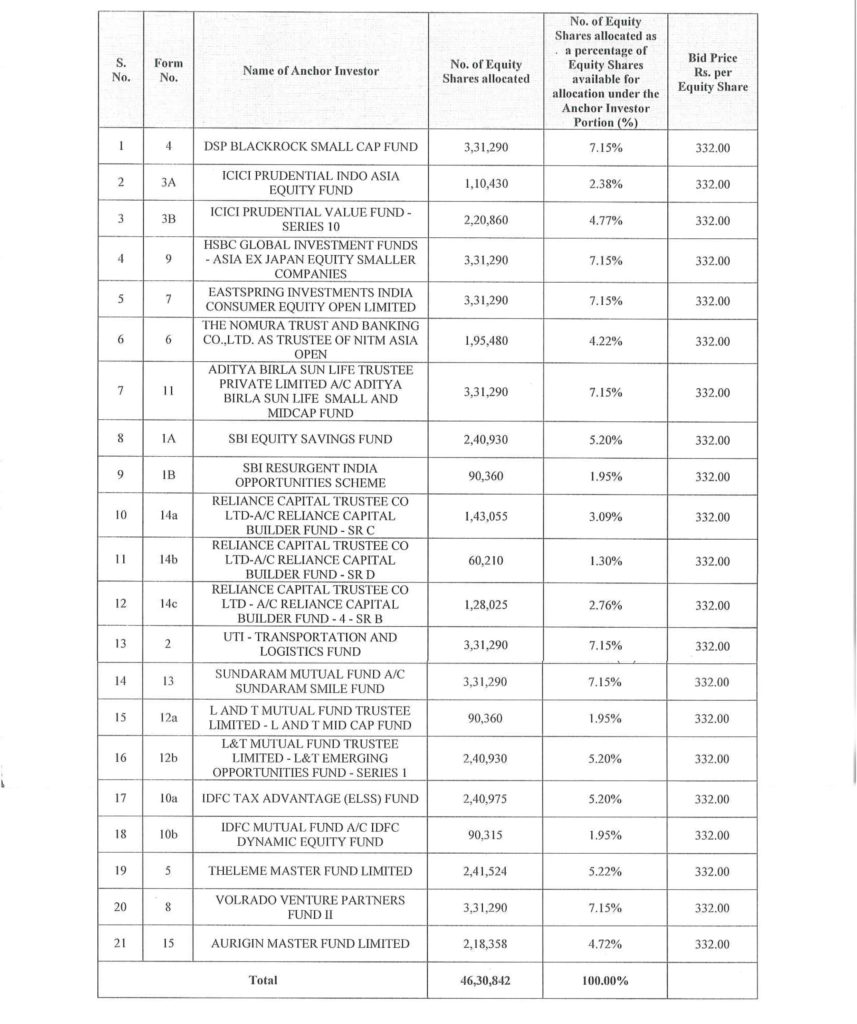

The company allotted 46,30,842 equity shares to 15 anchor investors comprising of 21 entities. The highest allocation made was of 3,31,290 equity shares or 7.15% of the anchor portion. This was made to seven anchor investors and included names like DSP Blackrock, Aditya Birla Sun Life and UTI amongst others. Some others like ICICI Prudential were allotted the same amount in a combination of more than one fund.

The PE multiple based on consolidated results for March 2017 is between 42.69-43.34 times its EPS of Rs 7.16. The EPS for the half year ended September 2017 has increased significantly with many plants achieving better operating levels and has improved to Rs 6.69 for the half year. If one were to annualize the same it is Rs 13.38. The PE multiple at these earnings is a more reasonable 24.43-24.81 times.

The full list of anchor allocation is given below: –