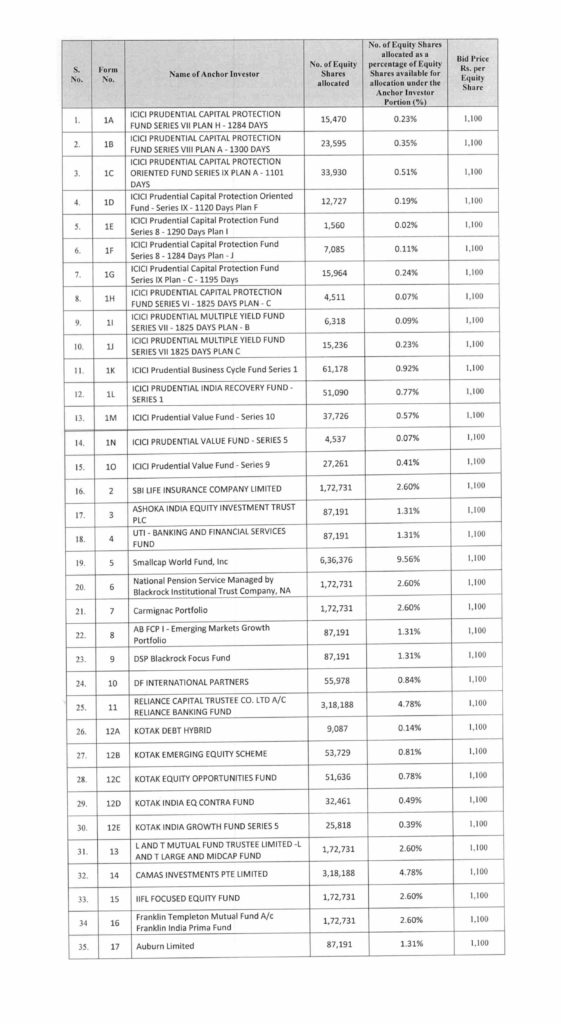

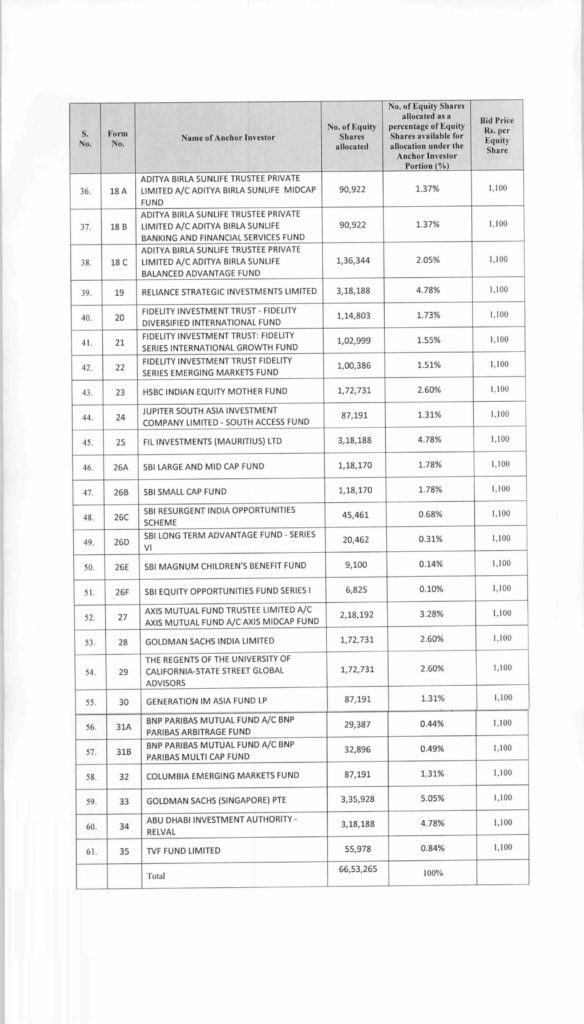

HDFC Asset Management Company Limited which is tapping the capital market with its offer for sale completed allocation to anchor investors. The company allotted 66,53,265 equity shares to 35 anchor investors comprising of 61 entities at Rs 1,100 which is the top end of the band. The companies offer for sale consists of 2,54,57,555 equity shares in a price band of Rs 1095-1100.

There is a very active grey market on for the shares of HDFC AMC and the premium is a good 40% of the issue price. The same is because the general expectation was that the share price would be in the Rs 1300-1350 range because the preferential offer to distributors was made at Rs 1050. SEBI struck down the preferential offer made on 30th April of 14,33,600 shares at Rs 1050 and asked the company to cancel the same and pay 12% interest on the intervening period.

The impasse was resolved with HDFC selling these preferential shares at Rs 1075 which included the issue price of Rs 1050 and interest of Rs 25. This became a price discovery with KKR picking up 12.61 lac shares.

This lower price than anticipated has caused the hype in the market. NBFC’s have also jumped into the fray and hiked up interest rates from the 5-5.5% to 9-9.5%. Watch this space for the next three days for further updates.

The full list of anchor allotment with shares is given below: –