Friday and markets seem to have a strange connection. The Finance Minister loves to have her press conferences post market at either 4 pm or 6 pm on Friday. This time however the day remained the same but the time was changed to morning. The impact was there for all to see particularly with the PM Modi spending his next seven days in the US. The markets gained a whopping 1,921 points on the BSESENSEX and 570 points on NIFTY.

The weekly change was 629.93 points on BSESENSEX or 1.68% to close at 38,014.92 points. NIFTY gained 198.30 points or 1.79% to close at 11,274.20 points. The broader markets saw BSE100, BSE200 and BSE500 gain 2.05%, 2.12% and 2.03% respectively. BSEMIDCAP was up 3.33% while BSESMALLCAP gained 1.47%. It was a day when a stock like Maruti saw an intraday move of Rs 1060 and closed with gains of Rs 648 for the day and Rs 135 for the week.

The Indian Rupee was volatile and finally closed virtually unchanged, losing 2 paisa or 0.03% to close at Rs 70.94. Dow Jones lost 284.45 points or 1.05% to close at 26,935.07 points.

Press conferences by the Finance Minister have been held typically post market at 4pm or 4.30 pm on Friday’s. This was the first time that it was held in the morning. It certainly should have rung a bell in the mind of the canny investor or trader. Secondly it was on the eve of the departure of the PM on his week-long trip to the United States which includes the event Howdy Modi, and the UNGA (United Nations General Assembly) meeting. This did not ring a bell in the minds of market participants and bears were caught with their pants down. The FM announced a cut in corporate tax to 22% plus surcharge for those who did not take exemptions. This would make the peak rate at 25.17%. It also reduced MAT (minimum alternate tax) to 15%. The FM also introduced a new tax rate of 15% plus surcharge becoming effectively 17.01% for new companies incorporated after 1st October 2019 and commencing production before 31st March 2023. Very clearly this section is to induce American companies looking to find alternative place to relocate after Donald Trump has asked them to shut down China operations. At this tax rate India becomes competitive with its other South East Asian competitors. Earlier the government had allowed 100% FDI in contract manufacturing.

It is widely expected that GSP (generalised system of preferences) which was enjoyed by India and recently discontinued would be restored. This would help India enjoy preferential treatment in its foreign trade. Further some sort of agreements on energy security and American companies coming to India to set up manufacturing bases are expected. This would boost the make in India program and help in kick starting the Indian economy.

The GST council has also made changes in GST applicable to hotel rooms where if the room tariff is upto Rs 1000, there would be no GST. In the bracket of Rs 1,000 to Rs 7,500 it would be 12% and at 18% for rooms above Rs 7,500. This would act as a boost for the tourism industry. Further the GST on aerated drinks has been increased from 18% to 28% plus 12% additional cess.

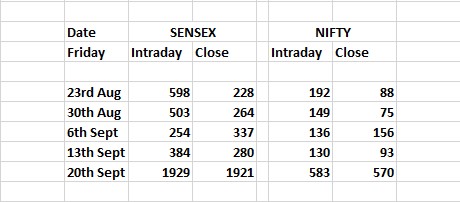

The Friday factor and the impact it had on the markets can be gauged from the table given below.

From the above we can see that the markets have a close connection with Friday and so does the FM. Last Friday was special as it coincided with the visit to USA of the Prime Minister. The tax cut is even more significant than any of the announcements made in Modi 2.0. One can also conjecture that individual tax changes are now around the corner.

Last night the Howdy Modi show was a grand success. The statement made by PM Modi about terrorism and also endorsed by Donald Trump is testimony of the closeness and significance of this visit. The PM also mentioned about the deal making abilities of Trump which signifies more such deal announcement over the next 4-6 days.

Petronet LNG has entered into a non-binding agreement with Tellurian to buy 5 million tons per annum of LNG concurrent with equity investment. Expect more deals to be announced on this trip of the PM.

Elections have been announced for the states of Maharashtra and Haryana to be held on Monday the 21st of October. The counting and declaration of results would take place on Thursday the 24th of October.

For those who are technically inclined, the low on 20th September was quite similar to the one on 23rd August with the tow levels being 36,102.35 points (23/o8) and 36,085.74 (20/09). Similarly, on NSE it was 10,637.15 points (23/08) and 10,691.00 points (20/09). With such strong support and momentum, it can now be said that an immediate term bottom has been made.

The week ahead has September futures expiring on Thursday the 26th of September. The present level of NIFTY at 11,274.20 points, is higher by 325.90 points or 2.98%. Momentum is now with the bulls and PM Modi having an action-packed week in the US, one can be sure that there will be plenty for the markets on a daily basis.

With so much at stake, all focus and action would happen in the United States of America. After the Howdy Modi and the UNGA address by Modi, focus would be on what large infrastructure projects could India get. The change in tax rates would broadly see corporate India’s performance improve by between 8-12% as far as earnings go. While Friday saw a huge jump in indices, the negative bias in the markets still seems to continue. Expect short covering in the week ahead and a successful and profitable expiry for bulls. The breadth of the market is expected to increase significantly with midcap and small cap shares participating. Enjoy the rally, it sure has taken a very long time coming.