Aptus Value Housing Finance India Limited which is tapping the capital markets with its fresh issue of Rs 500 crs and an offer for sale of 6,45,90,695 shares completed allocation to anchor investors. The price band of the issue is Rs 346-353. The issue opens on Tuesday the 10th of August and closes on Thursday the 12th of August.

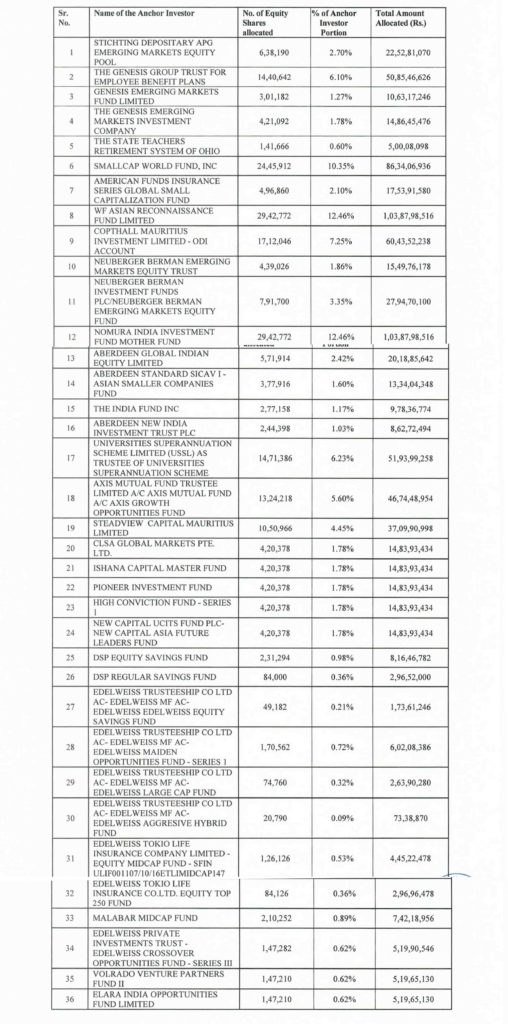

The company allotted 2,36,26,500 equity shares to 26 Anchor investors comprising of 36 entities at the top end of the band of Rs 353. The highest allocation was made to WF Reconnaissance Fund Limited who was allotted 29,42,772 shares or 12.46% of the anchor allotment. This was followed by Smallcap World Fund who was allotted 24,45,912 shares or 10.35% of the anchor allotment. This was followed by the Genesis group who was allotted 9.15% of the shares through 3 entities. The top 3 anchors were allotted 31.96% of the anchor book.

Overall, FPI’s were allotted 91.72% of the anchor book while Domestic investors were allotted 8.28% of the book. FPI’s love the business of affordable housing, retiral homes and the concept of first-time homebuyers by the unbanked and are willing to pay unheard of valuations for the same.

The full list of anchor allotment is given below: –