Credit Access Grameen Limited which is tapping the capital markets with its simultaneous offer completed allocation to anchor investors. The issue consists of a fresh issue of Rs 630 crs and an offer for sale of 1.18 cr shares in a price band of Rs 418 to 422. The company would raise Rs 1,131.18 crs at the top end of the band.

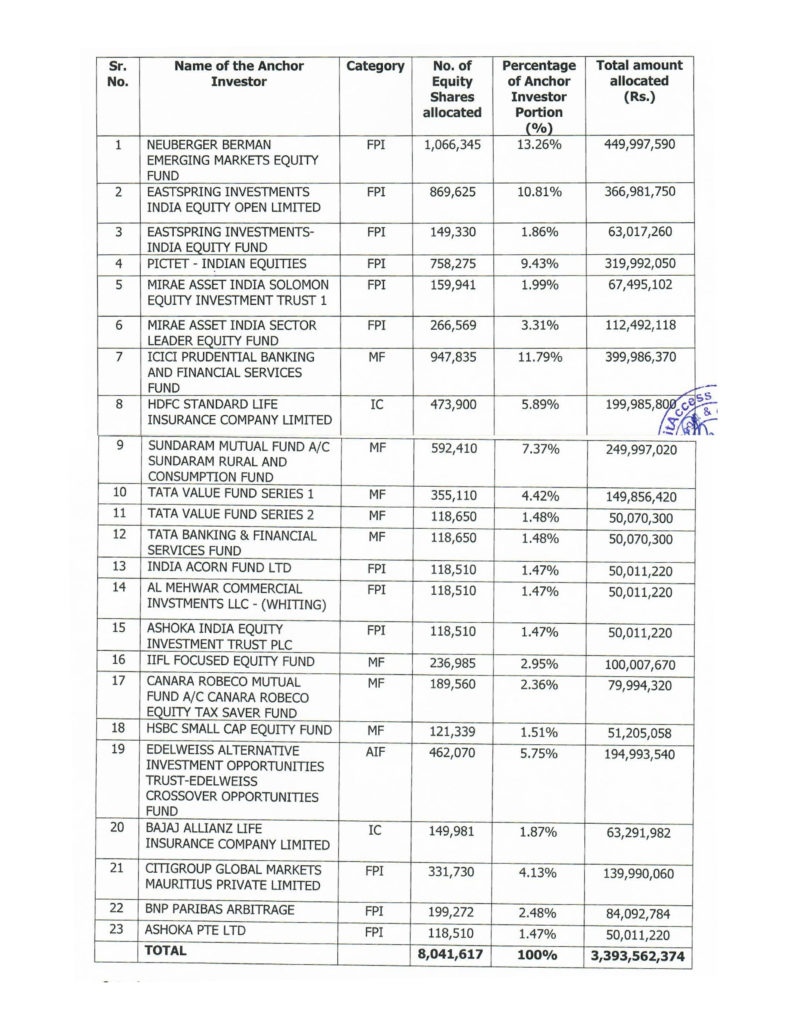

The company allotted 80,41,617 shares to 20 anchor investors comprising of 23 entities. The top allocation was made to Neuberger Berman Emerging Markets Equity Fund who was allotted 10,66,345 equity shares or 13.26% of the equity. The next in order was Eastspring Investments India Equity Fund under two entities who were allotted 10,18,955 equity shares or 12.67% of the anchor allocation. The third was ICICI Prudential Banking and Financial Services Fund was allotted 9,47,835 equity shares or 11.79% of the anchor book. The top three anchors comprising of four entities have been allotted a total of 30,33,135 equity shares or 37.72% of the anchor book.

The company is in the business of micro finance and more than 73% of its AUM is from rural India. The company unlike some of its peers does not plan to become a small finance bank any time soon and is quite happy with its present business model which has seen a CAGR in AUM of 57%. The current AUM as of 31st March 2018 was at Rs 4,974 crs.

The issue looks very promising and the proof of the pudding would be when the issue closes for subscription on Friday the 10th of August.

The full list of anchor investors and their allocation is given below: –