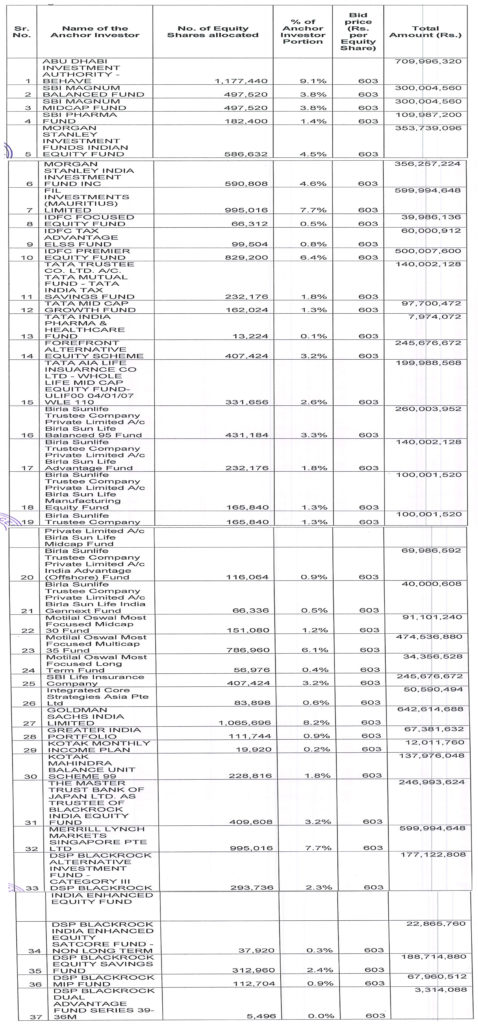

Eris Life Sciences Limited which is tapping the capital markets with its offer for sale of 2,88,75,000 equity shares in a price band of Rs 600-603 completed allocation to anchor investors. The company allotted 1,29,26,250 equity shares to 21 anchor investors comprising of 37 entities at the top end of the price band of Rs 603.

The issue has opened on Friday the 16th of June and closes on Tuesday the 20th of June.

This company manufactures drugs and is located in Guwahati in Assam where it gets tax breaks. The capacity utilised is around 30% and yet the company gets it products manufactured from third party. Benefits are available only from manufacturing, hence am at a complete loss why this model continues. Keeping your own unit under capacity and getting the same manufactured from third parties is baffling. Is there some hidden beneficiary in this deal or one should just ignore the same. Secondly for the last five years the company has been reporting profits and yet the issue has come under a dispensation under which the retail share is cut from 35% to 10%. This is meant for companies with inadequate profit record. How Eris qualifies for the same beats me. Is this a new way to restrict allocation to retail shareholders or not, or a way to benefit QIB allocation allotment which is on a discretionary basis. Thirdly the valuation of the offer for sale is ridiculously high at 34.07-34.24 times which is more than MNC’s like Abbott India, Pfizer and Sanofi. Beats me why such steep valuations.

There is a risk factor where there are complaints pending about the company spending on entertaining doctors. While the case is pending this is a serious issue as the company has always maintained that being in the business of chronic disorders the origination of business in the form of prescription is the key to the company. One final point is that of the companies top ten brands, five have lost rank in terms of prescriptions, three have remained unchanged and only two have gained ground. With so many issues in the market this week why bother about an issue with issues. When in doubt simply avoid.

The full list of anchor investors with their allocation is given below: –