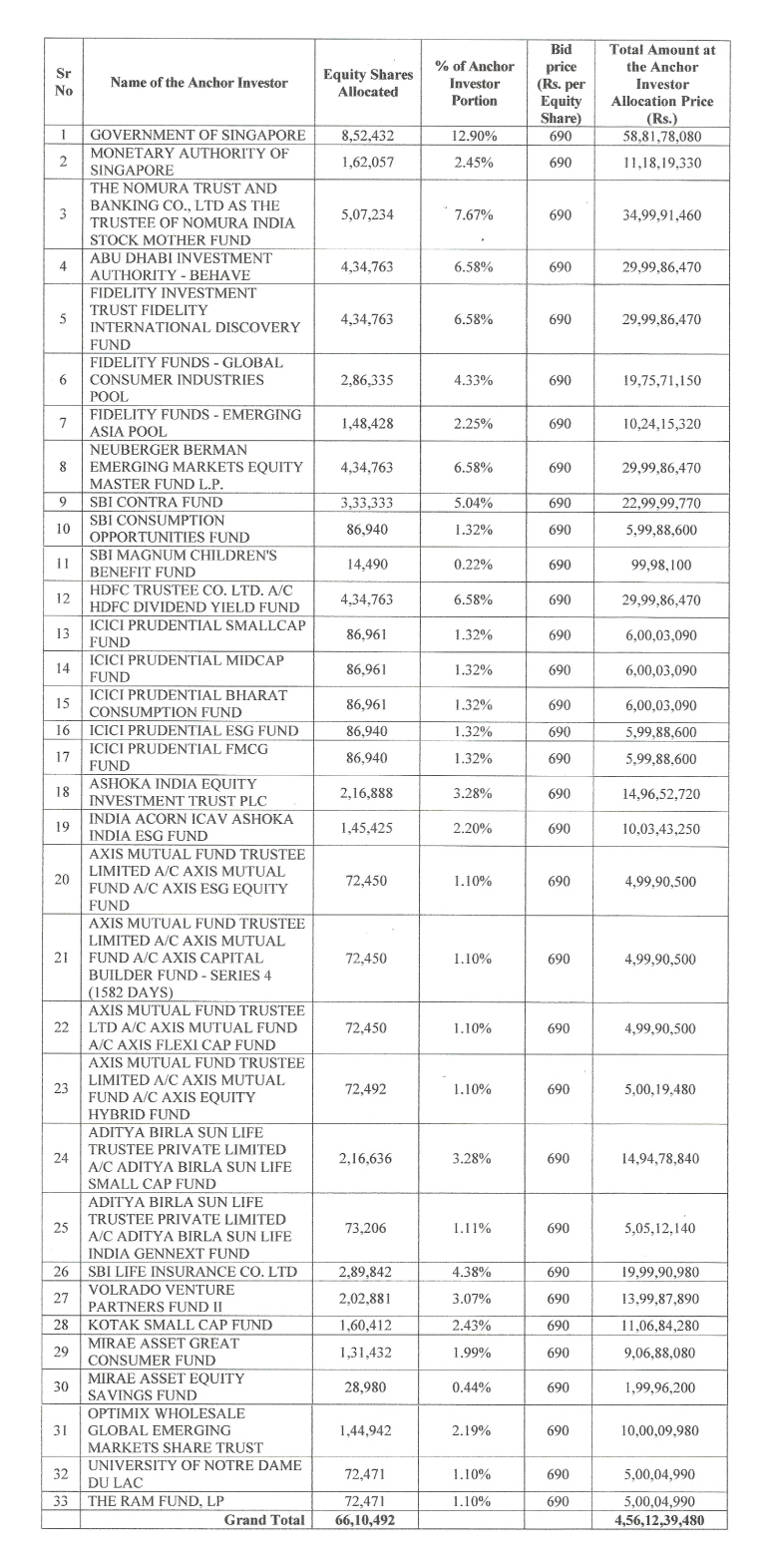

Go Fashion (India) Limited which is tapping the capital markets with its fresh issue for Rs 125 crs and an offer for sale of 1,28,78,389 shares completed allocation to anchor investors. The company allotted 66,10,492 shares at the top end of the price and of Rs 690. The company allotted the shares to 18 anchor investors comprising of 33 entities. The issue opens on Wednesday the 17th of November and closes on Monday the 22nd of November. The price band is Rs 655-690.

The highest allocation was made to the Government of Singapore who was allotted 8,52,432 equity shares or 12.90% of the anchor allotment. Its associate, the Monetary Authority of Singapore was allotted 1,62,057 shares or 2.45% of the anchor book making a total of 10,14,489 shares or 15.35% of the anchor book. This was followed by Fidelity funds who were allotted 13.16% of the book to three entities. Three domestic funds, namely ICICI, HDFC, and SBI were allotted almost an identical 6.58% of the anchor book. This meant that the top 5 anchor investors were allotted 48.27% of the anchor book.

Domestic mutual funds were allotted 22,04,797 equity shares or 33.35% of the anchor book. This was to 7 mutual funds comprising of 18 schemes.

Full details of the anchor allocation are given below: –