Happiest Mind Technologies Limited, a company promoted by Ashok Soota, formerly of Mindtree is entering the capital markets with its fresh issue of Rs 110 crs and an offer for sale of 3.566 cr shares in a price band of Rs 165-166. The issue opens on Monday the 7th of September and closes on Wednesday the 9th of September.

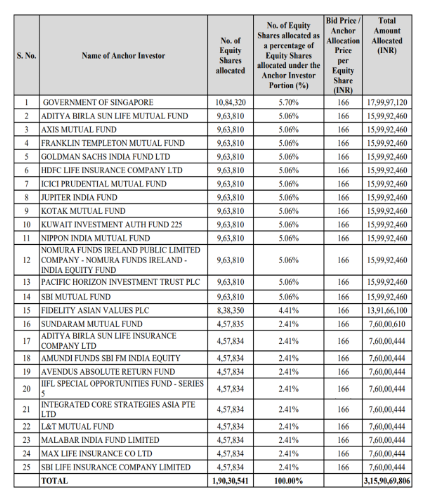

The company allotted 1,90,30,541 equity shares to 25 Anchor investors comprising of 38 entities. The highest allocation of 10,84,320 equity shares has been made to Government of Singapore. This amounts to 5.70% of the issue size. The next highest allocation is made to 13 investors who have each been allotted 9,63,810 shares or 5.06% of the anchor allocation.

The company issue size is roughly Rs 702 crs from the fresh issue and offer for sale components combined. The company is offering shares at a PE multiple of 30.8 to 31 times its diluted earnings of Rs 5.36 for the year ended March 2020. Though the issue looks expensive when compared with its peers like TCS at 26.1 PE and Infosys at 24.3 times, this has become the norm with almost all issues that tap the markets being offered at higher valuations than the peer group. On top of this there is a grey market premium of Rs 110, which means an additional PE of 20.5 times making the market price a steep 50.5 times. The issue would be oversubscribed as HNI’s would borrow and apply. It’s time for the regulator to look at this category of investors who borrow money and apply and throw all conventional norms to the wind with margins of just 0.5% to 3%. They also disrupt the supply demand equation.

The grey market premium of Rs 110 discount a subscription of 450 times in the HNI category as the cost of funds at Rs 7.5% would entail a cost of Rs 0.24 per time. This implies that 450 times over subscription would make the funding cost Rs 108 per share. In case the subscription level is higher or lower, the premium should vary and accordingly would result in gains or losses. As far as retail investors are concerned, the issue size is Rs 70 crs and would require 46,900 forms for oversubscription on one lot basis. To expect the retail portion to be subscribed anywhere between 15-20 times would not be out of place currently.

The choice to apply or not apply is in the hands of the investor. In retail the application would be by lottery while in the HNI category it would be at a huge cost of interest.

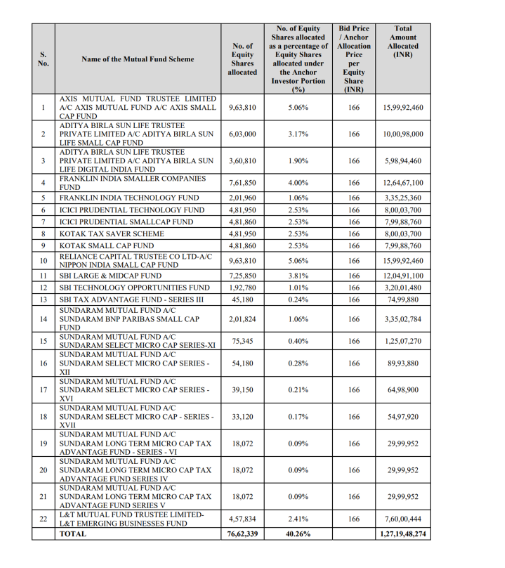

Full details of the anchor allocation are given below: