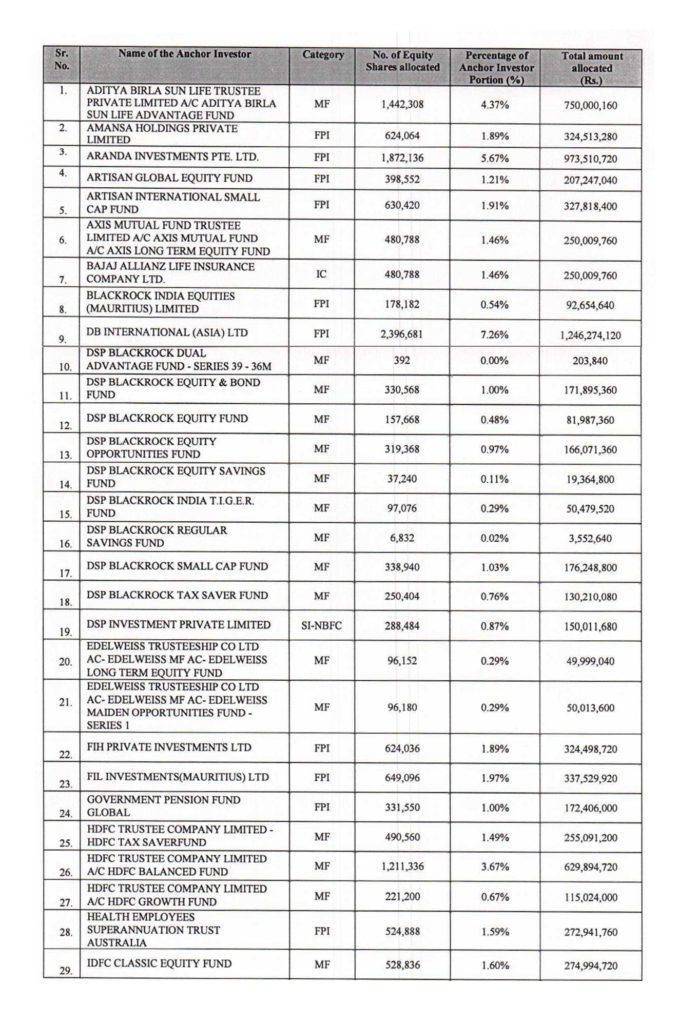

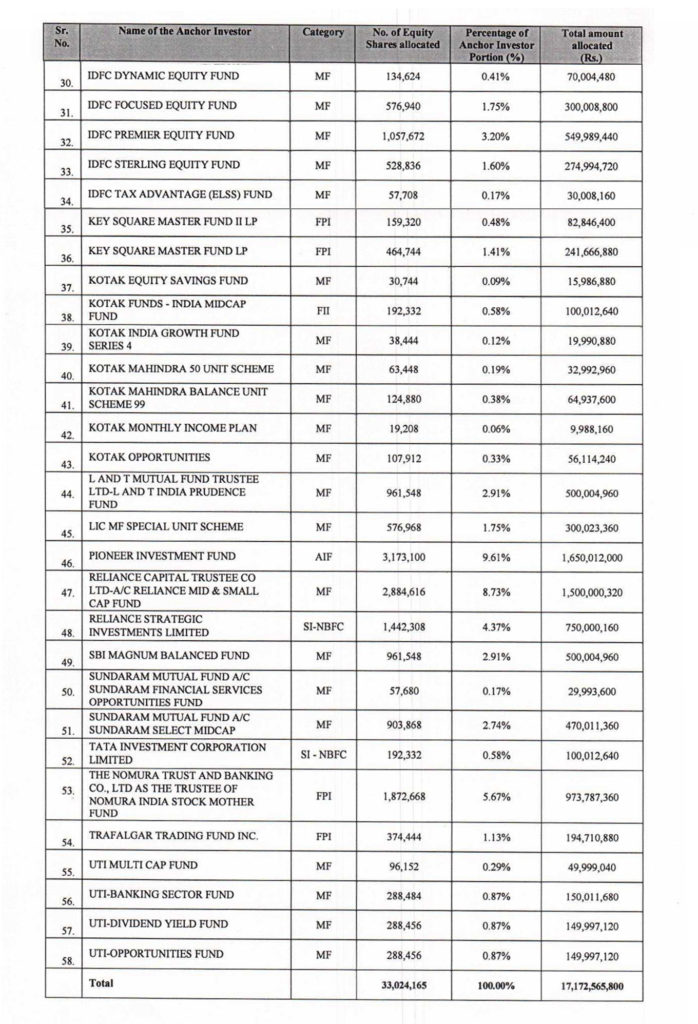

ICICI Securities Limited which is tapping the capital markets with its offer for sale of 7,72,49,508 shares completed allocation to anchor investors. The company allotted 3,30,24,165 equity shares to 33 anchor investors comprising of 58 entities. The price band is Rs 519-520. The issue has opened on Thursday the 22nd of March and closes on Monday the 26th of March.

The highest allocation has been done to Pioneer Investment Fund who has been allotted 31,73,100 shares or 9.61% of the anchor allocation.

The issue is richly valued and does not offer scope for appreciation on listing. The earnings for the year ended March 2017 were at Rs 10.48 which puts the price band at 49.4-49.5 times. The earnings for the first nine months ended December 2017 were at Rs 12.39 which if annualised comes to Rs 16.52. The PE multiple at these earnings is 31.41 to 31.47. The company is promoted by a bank and therefore unlike its peers in the broking fraternity does not have a NBFC arm. It has however introduced a margin funding product and has raised commercial paper for the same. Going forward if this product does well, I believe the company is likely to strengthen the product and introduce newer variants which would include loan against shares and IPO application funding.

The full list of allotment and anchor investors is given below: –