Lemon Tree Hotels Limited which is tapping the capital markets with its offer for sale of 9,45,00,053 in a price band of Rs 54-56 completed allocation to anchor investors. The issue opens on Monday the 26th of March and closes on Wednesday the 28th of March.

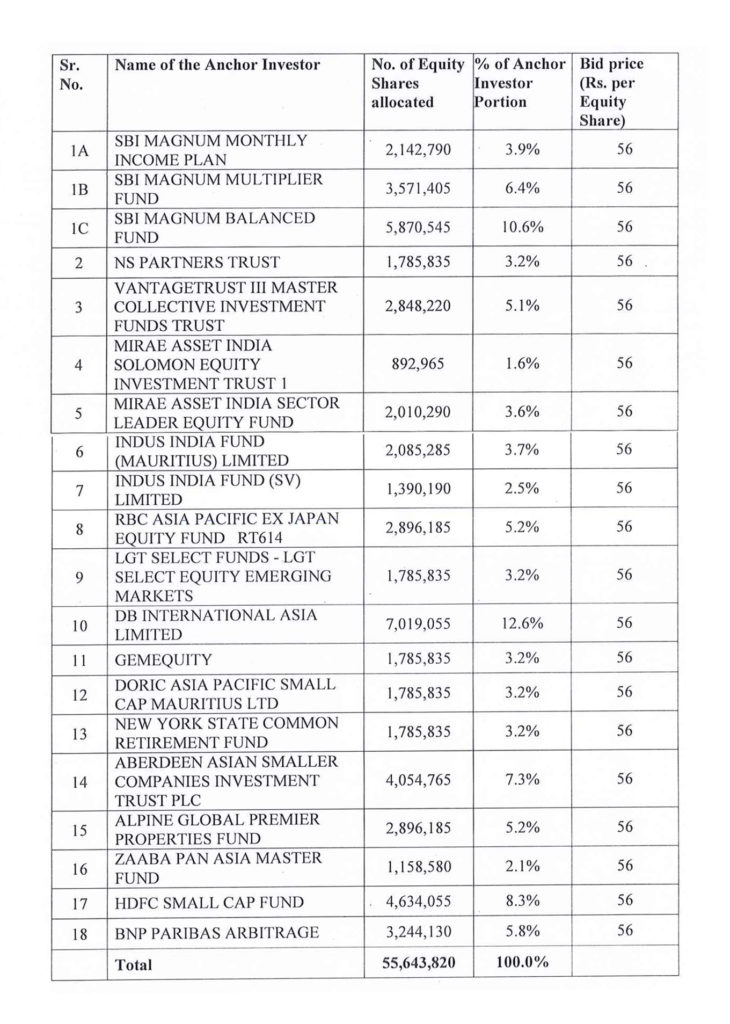

The company allocated 5,56,43,820 equity shares to 18 anchor investors comprising of 20 entities. The highest allocation was made to SBI Mutual Fund of 1,15,84,740 equity shares which corresponds to 20.90% of the anchor allocation.

The issue is priced at a PE multiple of 771.43 – 800 times based on the standalone numbers for year ended March 2017. If one were to consider the NAV method or book value method it is at 3.57 times its consolidated book value of 15.66 as of 31st December 2017. This is in comparison to Indian Hotels Company which is available at 3.70 times and is significantly bigger than Lemon Tree in terms of properties, rooms available and revenues.

Full details of the anchor allocation is given below: –