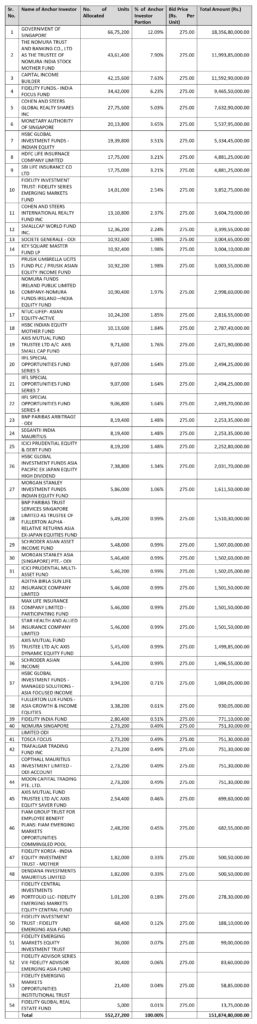

Mindspace Business Parks Reit (Mindspace) which is tapping the markets to raise Rs 1,000crs through a fresh issue and Rs 3,500 crs through an offer for sale, completed allocation to anchor investors. The REIT allotted 552.272 lac units at Rs 275 to 54 investor’s worth Rs 1,518.7 crs. The highest allocation was made to Government of Singapore who was allotted 66,75,200 units worth Rs 183.57 crs. This formed 12.09% of the anchor allocation.

The issue opens for subscription on Monday the 27t of July and closes on Wednesday 29th July. The price band is Rs 274-275. 75% of the issue is reserved for institutional bidders and 25% for non-institutional bidders. Post the allocation to strategic investors of Rs 1,125 crs the size of the offering would be reduced to Rs 3,375 crs with QIB portion Rs 2,531 crs and non-institutional portion Rs 843.75crs. With the anchor allocation completed, the QIB portion would be reduced to Rs 1,012.25crs.

The net asset value of the units as on 31st March 2020 was Rs 319.50, which effectively means that the selling price at the top end of the band is a discount of 13.9%. The units are expected to earn a yield of 7% in the current year rising hereon to be effectively 7.5% in the next year. The return would be distributed in the form of dividend to the extent of 90% and the balance in the form of interest. The dividend would be tax free in the hands of the investor and there would be no tax paid by the individual as part of his income as they are exempt under section 10(23 FD). SEBI has been encouraging the participation of small investors in these instruments which come under the head of INVITS and REITS, by reducing the ticket size periodically. The ticket size began at Rs 10 lacs, was reduced to Rs 5 lacs and then to Rs 2 lacs and finally to Rs 50,000. Considering the fact that the allocation in the issue from Mind Space consists of just two buckets namely Institution and non-institution, pairing HNI with Retail is most unfair and goes against the very spirit of encouraging small investors. The allocation would be pro-rata and this would ensure that retail applicants are butchered in allotment as happened in the shareholder quota of SBI Cards Issue. Here the allocation was extremely skewed and caused huge heartburn. SEBI would be well advised to ensure equitable distribution, like is done in equity issues where one lot is first given to all applicants and the balance then distributed on a pro rata basis.

The full list of anchor investors with the allocation is given below: –