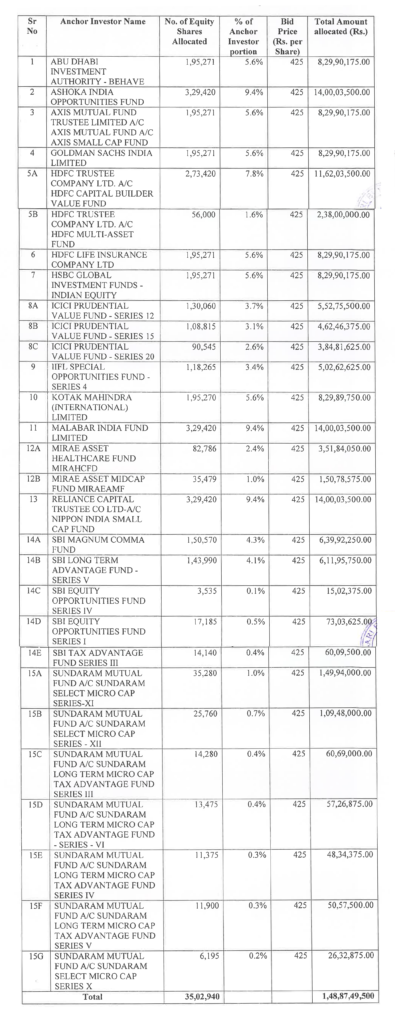

Rossari Biotech Limited which is tapping the capital markets with its simultaneous fresh issue of Rs 50 crs and an offer for sale of 1.05 cr shares completed its allocation to anchor investors. The company allotted 35.02 lac shares to 15 anchor investors comprising of 29 entities. The highest allocation of 3,29,420 shares was made to three individual investors which constituted 9.4% of the anchor allocation was made to Ashoka India, Nalanda Fund and Nippon India. Besides the above, three mutual funds HDFC, ICICI and SBI were also allotted the similar 9.4% in various schemes. The price band is Rs 423-425. The issue opens on Monday the 13th of July and closes on Wednesday the 15th of July.

The PE multiple of the issue is steep at 31.52 at the lower end of the band and 31.67 at the top end of the band. The company had earned an EPS of Rs 13.23 on a diluted basis for the year ended March 2020.The company has on Friday allotted 35.02 lac shares to 15 anchor investors comprising of 29 entities. While it has a good future and the capex being undertaken would bear fruit in the financial year 2021-2022, it looks expensive currently but could be invested in only if one is willing to wait for two years. Alternatively, one could invest when the markets cool off.

The full list of anchor investors with their allotment is given below: –