Sapphire Foods Limited which is tapping the capital markets with its offer for sale of 1,75,69,941 equity shares in a price band of Rs 1,120-1,180 completed allocation to anchor investors. The issue opens on Tuesday the 9th of November and would close on Thursday the 11th of November.

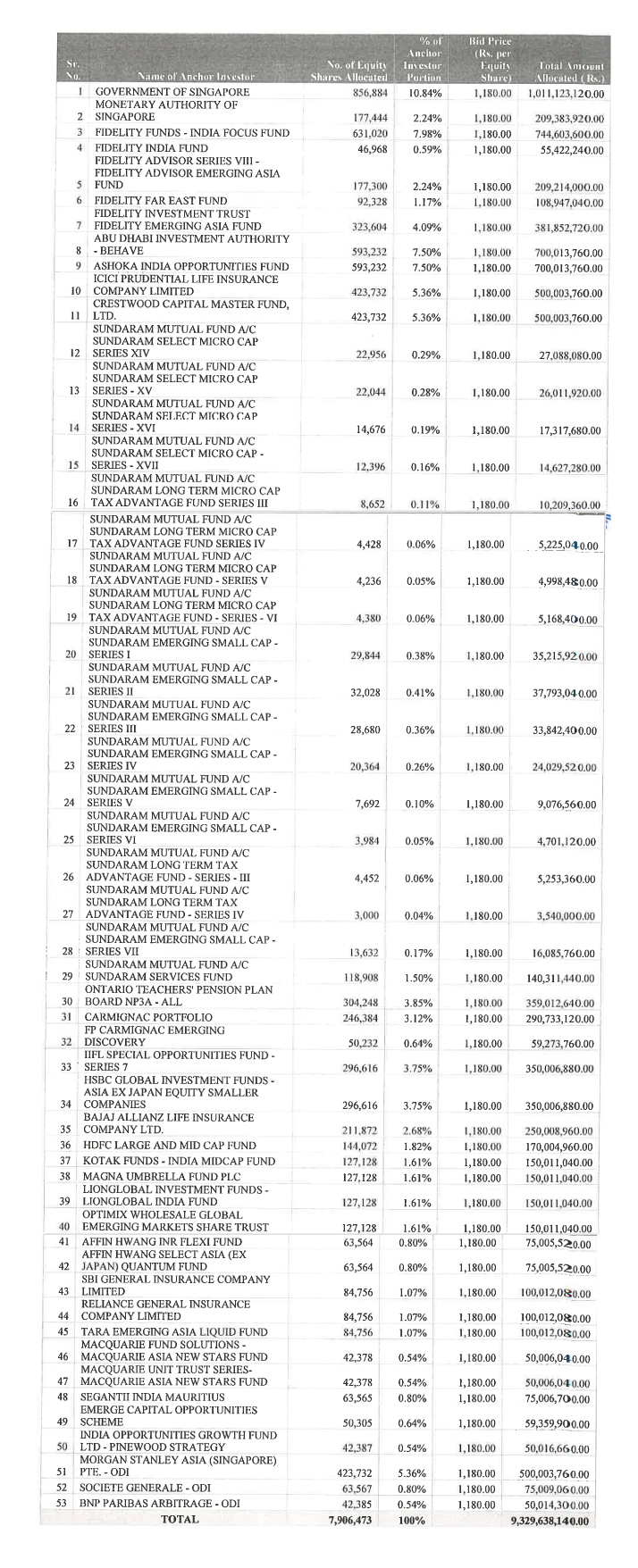

The company allotted 79,06,473 equity shares to 30 anchor investors comprising of 53 entities at the top end of the price band of Rs 1,180. The highest allocation was made to Fidelity Funds who were allotted 12,71,220 shares or 16.07% of the anchor book. This was followed by the Government of Singapore who was allotted 8,56,884 shares or 10.84% of the anchor book. Another associate, the Monetary Authority of Singapore was allotted 1,77,444 equity shares or 2.24% of the anchor book. This made a total of 10,34,328 shares or 13.08% of the anchor book. This meant that the top two anchors comprising of seven entities were allotted 23,05,548 equity shares or 29.15% of the anchor book.

Domestic mutual funds were allotted 5,00,424 shares or 6.33% of the anchor book. This was to two mutual funds with Sundaram being allotted 4.51% of the anchor book and HDFC being allotted 1.82% of the anchor book. Very clearly it appears that domestic mutual funds who are flush with funds have by and large chosen to give this issue the miss. Was it the valuations that kept them away? Not sure, but the India consumption story is intact, and issue after issue is getting received unless valuation stops funds.

Full details of the anchor allocation are given below: –