Spandana Sphoorty Financial Limited which is tapping the capital markets with its simultaneous offer of a fresh issue of Rs 400 crs and offer for sale of 93,56,725 equity shares completed anchor allocation. The price band is Rs 853-856. The issue opens on Monday the 5th of August and closes on Wednesday the 7th of August.

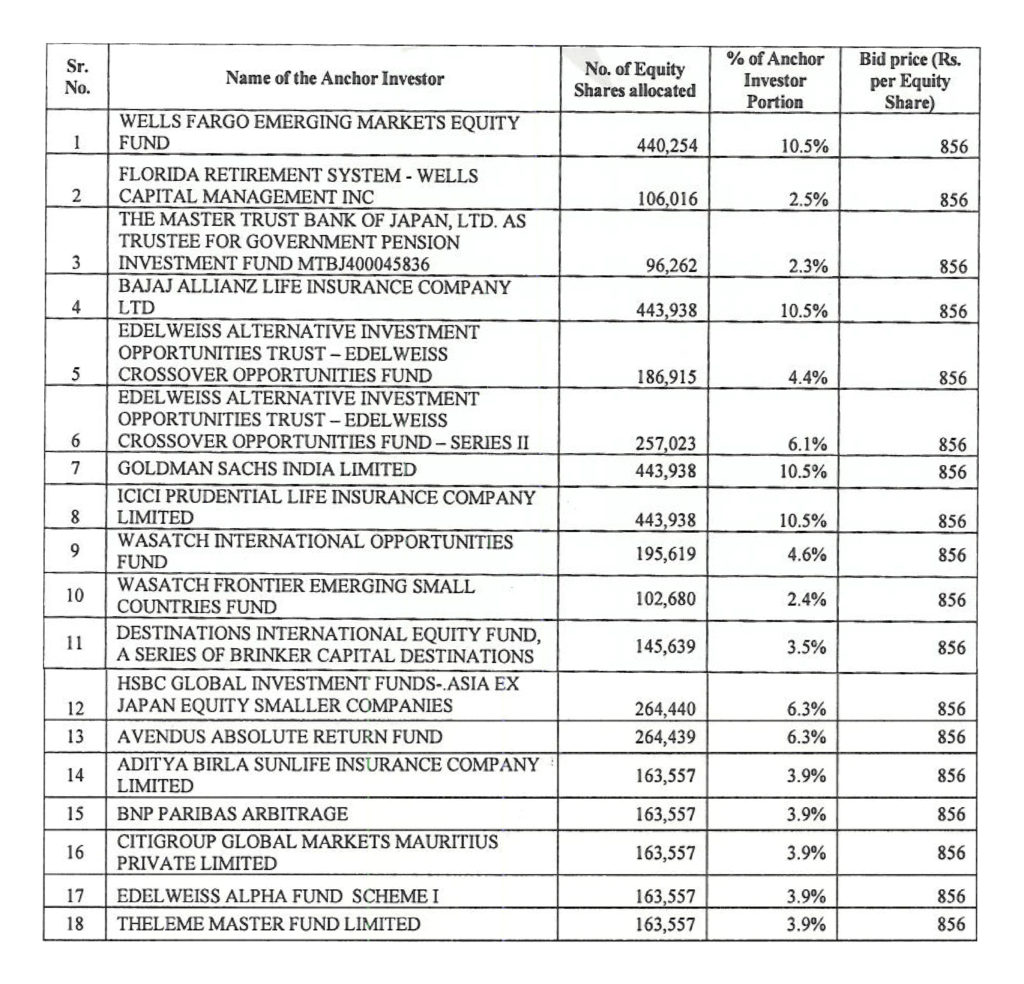

The company allotted 42,08,886 equity shares to 15 anchor investors comprising of 18 entities. The highest allocation was made to four investors of 4,43,938 equity shares representing 10.5% of the anchor allocation to Wells Fargo, Bajaj Allianz Life Insurance, Goldman Sachs and ICICI Prudential Insurance.

Spandana Sphoorty Financial Limited is a micro finance company. The company was admitted to CDR after the A P crisis in 2010 and successfully exited the same. It is now promoted by the original promoter Padmaja Gangireddy and corporate promoter Kanchenjunga Limited who has Kedaara driving the business. The shares are being offered at a price earnings multiple of 15.96-15.99 times based on consolidated earnings per share of Rs 53.35 for the year ended March 2019. The issue looks interesting and, in my opinion, maybe compared with Credit Access.

The full list of anchor allotment with the shares allotted is given below: –