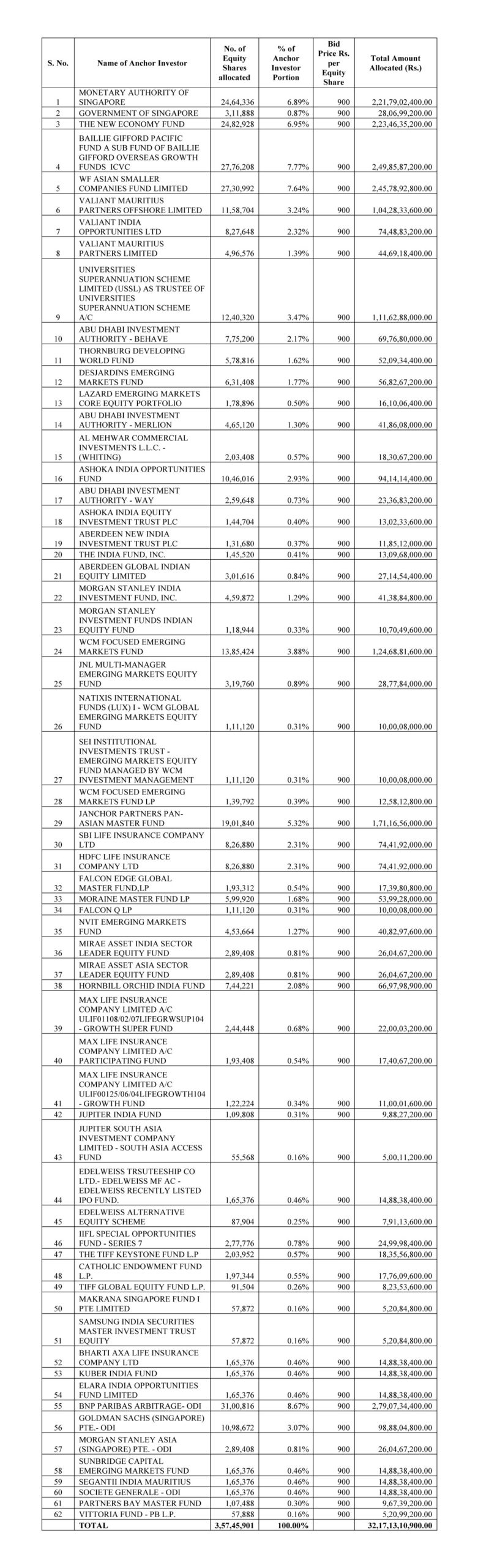

Star Health and Allied Insurance Company Limited which is tapping the capital markets with its fresh issue for Rs 2,000 crs and an offer for sale of 5,83,24,225 shares in a price band of Rs 870-900 completed allocation to anchor investors. The company allotted 3,57,45,901 equity shares to 49 entities comprising 62 entities at the top end of the price band of Rs 900.

The highest allocation was made to Baillie Gifford Pacific Fund who was allotted 27,76,208 shares or 7.77% of the anchor book. This was followed by the Monetary Authority of Singapore and the Government of Singapore who was allotted 6.89% and 0.87% of the anchor book, making a total of 27,76,224 shares or 7.76% of the anchor book. This was followed by the WF Asian Smaller Companies Fund who was allotted 27,30,992 shares or 7.64% of the anchor book. This was followed by Valiant who through three funds was allotted 24,82,928 shares or 6.95% of the anchor book.

The top four anchor investors were allotted 1,07,66,352 shares or 30.12% of the anchor book. The surprising thing was that there was just one domestic fund, Edelweiss Mutual Fund who invested 1,65,376 shares or 0.46% of the anchor book. Very clearly the non-participation by domestic mutual funds whatever be their reason is a disturbing thing as they are the entity that is witnessing the maximum fund flow currently.

The issue would garner Rs 7,249 crs at the top end of the band. The issue has opened on Tuesday the 30th of November and would close on Thursday the 2nd of December.

A full list of anchor investors with their allocation is given below: –