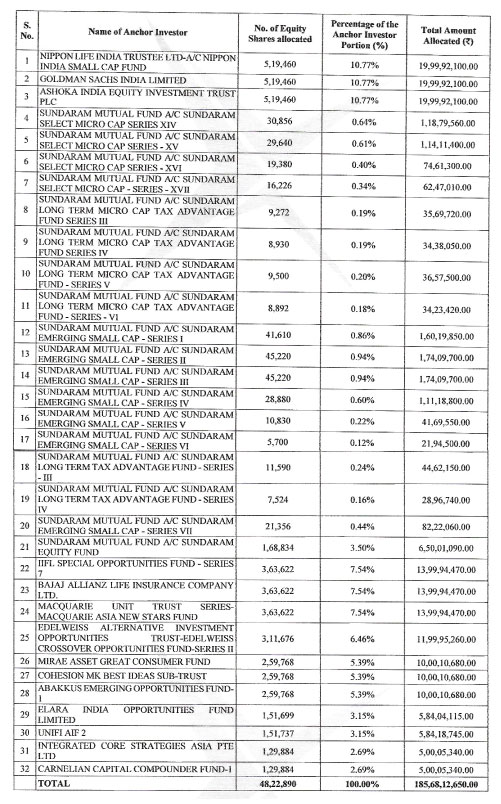

Stovekraft Limited which is tapping the capital markets with its fresh issue of Rs 95 crs and an offer for sale of 82.5 lac shares in a price band of Rs 384-385 completed allocation to anchor investors. The company allotted 48,22,890 equity shares at Rs 385 to 15 anchor investors comprising of 32 entities. The highest allocation of 5,19,460 shares or 10.77% was made equally to four investors namely, Nippon India, Goldman Sachs, Ashoka India Equity Fund and Sundaram Mutual Fund. This was followed by an equal allotment of 3,63,622 equity shares or 7.54% to three anchor investors. This meant that 65.70% of the anchor book was distributed amongst seven anchor investors.

While the anchor book is impressive, the performance of the company is lacklustre. The company managed to come into the black just before going public. Strange Coincidence! Based on the fully diluted and restated EPS for the year ended March 2020 of Rs 1.05, the PE is a staggering 366.67 times. Two of the large listed peers, TTK Prestige and Hawkins Cookers trade at a PE multiple of 44.93 and 42.25 times respectively.

While the issue getting subscribed looks certain, the timing of the issue, the profitability happening and increasing significantly during the severe lockdown and the valuations being asked for, lead one to believe that this is an issue where the applicant if successful must sell at 10am latest on listing day.

The issue opens for subscription on Monday the 25th of January and closes on Thursday the 28th of January.

Full list of anchors and their allotment is given below: –