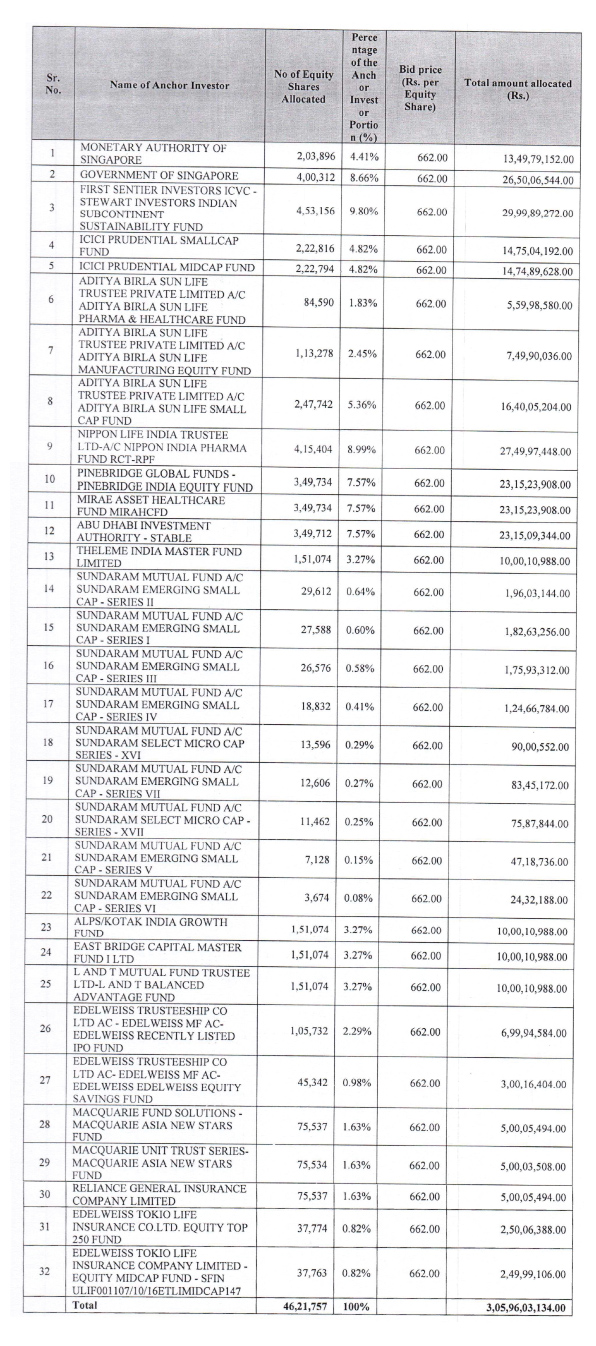

Tarsons Products Limited who is tapping the capital markets with its fresh issue for Rs 150 crs and an offer for sale of 1.32 cr shares in a price band of Rs 635-662 completed allocation to anchor investors. The company allotted 46,21,757 shares at Rs 662 to 32 entities. The highest allocation was made to Government of Singapore who was allotted 8.66% of the anchor book with its associate, Monetary authority of Singapore who was allotted 4.41%. The total allotted was 13.05% of the anchor book.

This was followed by 9.80% allotted to First Sentier Investors ICVC 9.80% of the anchor book. This was followed by an identical allotment of 9.80% to two domestic mutual funds who were allotted 9.64% each. They were ICICI Prudential and Aditya Birla Sun Life AMC. The top four anchor investors were allotted 42.13% of the anchor book.

The issue opens on Monday the 15th of November and closes on Wednesday the 17th of November.

Seven domestic mutual funds through 19 schemes were allotted 45.64% of the anchor book.

Full details of the anchor allocation are given below: –