Share is weak fundamentally and technically

Shares of Mid-Valley Entertainment Limited listed on the BSE where a listing ceremony was held. The company finally went the full hog this time. After four aborted attempts since 2000 when it could not go past the Draft Red Herring Prospectus (DRHP), this time it filed the Red Herring Prospectus (RHP), opened its issue successfully and even listed the same. It’s a different matter as to what would happen to the investors of the issue as there are no fundamentals in this company as of date.

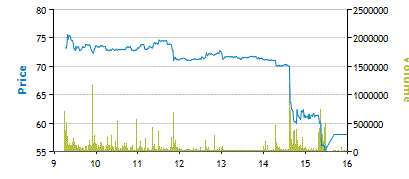

Coming to the listing itself, the share made its debut at Rs 73. The share made a high of Rs 76.50 and was trading in a broad range of Rs 71-74 for a good 5 hours of trade. Then the share started falling and as investors would recall another recent listing Shekhawati Poly-Yarns just fell and kept on falling. The share hit a low of Rs 55 and on a weighted average closed at Rs 58.05.

| Exchange | Open | High | Low | Close | Net Change | % gain | Wt Avg | Volume | Delivery | Del % age |

| BSE | 73.00 | 76.50 | 55.00 | 58.05 | -11.95 | -17.07 | 68.95 | 33871723 | 6443254 | 19.02 |

| Total | 33871723 | 6443254 | 19.02 |

The issue was to raise Rs 60 crs and a total of 85.71 lakh shares were issued at the top end of the price band at Rs 70. The company is in the business of exhibiting films and plans to have a contract with 300 such theatres. The traded volume was 338.71 lacs which was 3.95 times the IPO size. The delivery volume was 64.43 lakh shares which was 19 % of the traded volume and 75% of the IPO size. The delivery percentage on a traded volume is fairly high and it appears that after the last experience in Shekhawati Poly-Yarn traders have not jumped in to speculate in this share. It is probably for this reason that the trading volume remained at just under 4 times the IPO size unlike over 18 times in the case of the earlier IPO Shekhawati.

The weighted average of the day was Rs 68.95 while the closing price was Rs 58.05. Though from the weighted average one gets a feeling that people/investors got a chance to exit the company without losses or was able to make small profits, the reality appears different looking at the huge volumes which happened in the last half hour. The closing price was a loss of Rs 11.95 or 17.07%. The share looks weak and is likely to weaken further.

The weighted average of the day was Rs 68.95 while the closing price was Rs 58.05. Though from the weighted average one gets a feeling that people/investors got a chance to exit the company without losses or was able to make small profits, the reality appears different looking at the huge volumes which happened in the last half hour. The closing price was a loss of Rs 11.95 or 17.07%. The share looks weak and is likely to weaken further.

Investors are advised to stay away from this counter and if in any doubts about the fundamentals of the company read the issue analysis which is appended.