Engineers India Limited or EIL is tapping the capital markets with its FPO for 3.69 cr shares in a price band of Rs 145-150. There is a discount of Rs 6 for retail investors and employees. The issue has already opened on Thursday and will close on Monday the 10th of February. The issue has been fully subscribed by QIB’s and as of now it appears to be happening at the upper price band of Rs 150. The overall issue is oversubscribed 1.18 times as of now. The entire issue is an offer for sale with the government reducing its holding from 70.4% to 60.4%.

EIL is an engineering consultancy company providing design, engineering, procurement, construction and integrated project management services, principally focused on the oil and gas, petrochemicals, fertilizer and LNG industry segments in India and internationally. It also operates in other sectors including non-ferrous mining and metallurgy, power and infrastructure. EIL is also a primary provider of engineering consultancy services for the GOI’s energy security initiative under its Integrated Energy Policy for strategic crude storages.

Its services in these industries and sectors cover the entire spectrum of activities from concept to commissioning of a project. EIL’s services include preparation of project feasibility reports, technology selection, project management, process design, basic and detailed engineering, procurement, inspection, project audit, supply chain management, cost engineering, planning and scheduling, facilitation of statutory and regulatory approvals for Indian projects, construction management and commissioning. It also provides specialist services such as heat and mass transfer equipment design, environmental engineering services, specialist materials and maintenance services, energy conservation services, plant operation and safety services. EIL also executes projects on a turnkey basis.

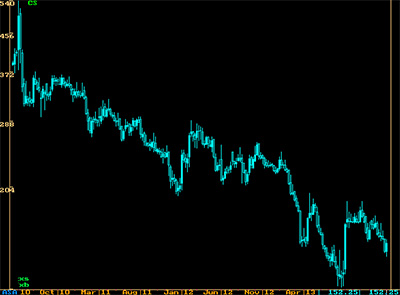

The share price of the company has been on a downswing since the last FPO which happened in July-August 2010. The price band at that time was Rs 270-290 with a discount of 5% to retail investors. Times have changed and the company has taken corrective action in mitigating the risks. They have diversified into areas other than the hydrocarbon space and also increased the area of operation from just India to include the Middle East, Asia and Africa.

Results have been poor in the year gone by and the EPS for the nine month ended December 2013 is Rs11.17 on a standalone basis. If this was to be annualised it would correspond to an EPS of Rs 14.89. The PE of the present offer is more or less 10 times and if one were to consider the past track record and the present order book it seems to be attractive to invest.

The biggest negative is the poor track record of the share price since the previous FPO.

I believe it makes sense to subscribe to the above issue as the price looks like rock bottom and with the risk mitigation done by the company it offers scope for appreciation in the medium term.

SEBI disclaimer: – I intend to subscribe to the above issue