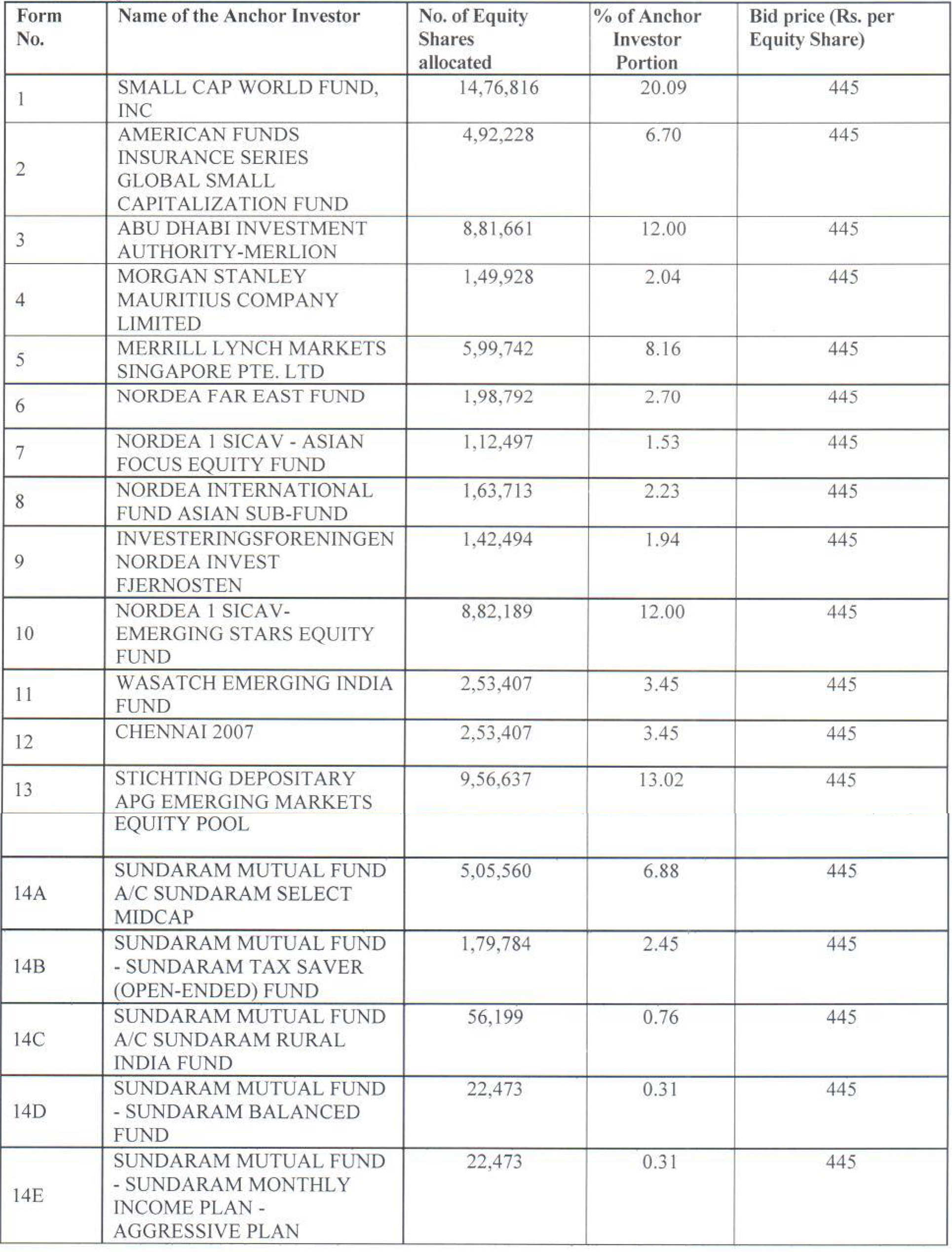

Varun Beverages Limited which is tapping the capital markets with its simultaneous offer for sale of 1 cr shares and fresh issue of 1.5 cr shares completed allocation to anchor investors. The price band is Rs 440-445. The issue opens on Wednesday the 26th of October and closes on Friday the 28th of October. There are a total of 14 anchor investors comprising of 18 entities and they were allotted 73.50 lakh shares. What is a little odd is that the anchor allotment was upto 30% of the QIB which would have been 75 lakh shares, but allotment is for 73.5 lakh shares. What is however surprising is that mutual funds who are flush with funds have not taken to the issue and there is just one Indian mutual fund who has applied in five schemes. Sundaram Mutual Fund has been allotted 7,86,489 shares or 10.70% of the anchor book.

Quite surprising when mutual funds are flush with funds and are looking for stock ideas and the India growth story is being talked about why this reluctance to apply for this issue. In contrast the anchor allocation a day ago was of a different kind with there being 45 anchor investors and 71 entities. In the case of Varun Beverages the highest allotment has been made to Stichting Depository with 13.02% allocation followed by jointly of 12% each to Abu Dhabi Investment Authority and Nordea. Clearly there is domination in allotment and the company had little choice with the issue not being oversubscribed.

The full list of anchor investors and their allotment is given below: –