IDFC which has been granted status as an Infrastructure Finance Company is eligible to issue bonds under section 80CCF. The issue size is upto Rs 3,400 crs and the issue which is currently open loses on Friday the 22nd of October.

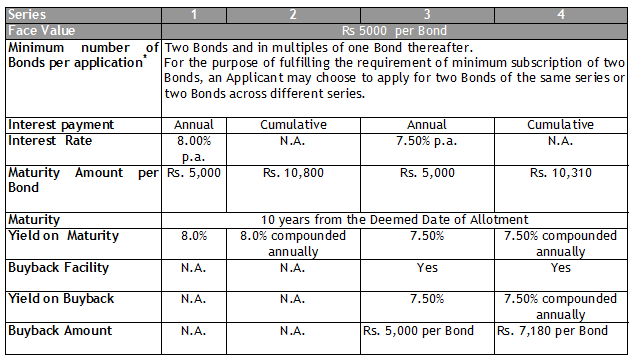

The salient features of the scheme are given below: –

The company offers 8% coupon rate without the buyback facility and 7.5% if the buyback facility is opted for. The bonds have a mandatory lock-in for 5 years and would be listed on the NSE thereafter. The company issuing the bonds needs no introduction and has a market capitalisation of approximately Rs 26,750 crs. The company has been paying dividends and had an EPS of Rs 7.79 for the year ended March 2010.

This is a straight tax saving instrument where the choice is limited to between choosing a scheme with buyback option and without buyback option and of course opting for the annual payment option or cumulative option.