Attractive coupon rate of 9.95%- Apply if you have the funds- Listing gains likely

State Bank of India (SBI) is issuing bonds worth Rs 2000 crs, where there is a reservation of 50% for retail investors, 25% for HNI’s and 25% for QIB’s. The issue opens on Monday the 21st of February and closes on Monday the 28th of February.

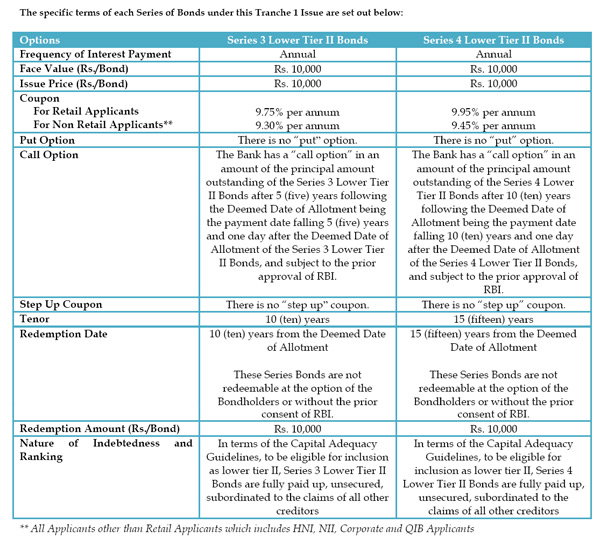

The salient features of this scheme is that the rate of interest for retail investors is 9.75% for 10 year duration bond while it is 9.95% for 15 year duration. Similarly for HNI’s and QIB’s the rate of interest is 9.3% and 9.45% respectively.

The bank had come out with an issue of bonds in September 2010 and the issue was very well received and was oversubscribed. Looking at the appetite and rising interest rates, SBI has launched this scheme with an interesting feature. There is an interest rate differential for retail and non-retail investors with retail getting higher interest rates. Secondly the rate varies for shorter duration and longer duration with the longer duration of 15 years getting higher rates of interest. Thirdly the bank looking at the response on the previous occasion has kept an option to retain oversubscription in the retail category upto Rs 9,000 crs. The offer is initially for Rs 2,000 crs with half for retail and half for non-retail. No oversubscription in the non-retail category would be accepted but in the retail category it would be accepted upto Rs 8,000 crs.

The investor is likely to make money on listing and it should be understood what could be the gain. On straight thinking one would believe that the yield on the 9.95% and 9.45% interest on 15 year duration bonds would converge. Logically this would be correct but in reality it would not be so. The demand would depend on what amount is received from retail and also what is the appetite of the non-retail category. One must also keep in mind that when these bonds are listed for trading we would be in the middle of March, when money markets are very tight and liquidity is not only a concern but is at a premium. The corporate sector may not look at buying these bonds from the secondary market immediately but wait for April or the new financial year.

The earlier series bonds which are quoted on the exchange are available at Rs 10,340-10,350 and include interest for 106 days at 9.5%. This implies that the interest component is Rs 276 and the premium is Rs 64. The interest rate on this instrument is 9.5% and the duration is 15 years. The other instrument having a coupon rate of 9.25% and duration of 10 years is quoting at a discount to its issue price as the interest component of 106 days is Rs 268 and the bond is available at Rs 10230-10250.

This clearly indicates that retail investors looking to apply in this issue must opt for the 15 year duration only and as the bond would be listed on the exchange. The price at which the bond would list would be a premium to the issue price and it is likely to be around 2.5% to 3%.

The one risk that investors run is that the price of this bond would adjust on a yield basis if interest rates were to move up. If however the interest rates fell (which looks unlikely now) the quoted price of this bond would rise.

Investors looking for a safe return and not knowing where to park their surplus funds when the markets seem to be going nowhere should opt for investment in this bond offering. The retail limit in the bond scheme is Rs 5 lacs for retail investors.

SEBI disclaimer: – I intend to apply for this scheme.