MMTC kicks of the divestment programme of the government for the financial year 2013-14. The government would be selling 933.12 lac shares at a floor price of Rs 60. The closing price of MMTC on BSE was Rs 211.45 and on NSE it was Rs 210.05. The floor price is a discount of 71.62% on the BSE and 71.43% on the NSE. Based on the floor price the government would realise Rs 559.87 crs assuming the offer is fully sold.

MMTC reported revenues of Rs 69,056 crs in the year ended March 2011, Rs 66,325 in March 12 and Rs 28,598 crs in the year ended March 2013. The net profit in March 11 was Rs 121.64, Rs 70.72 in March 12 and a net loss of Rs 70.62 in March 13. The EPS for the same period is Rs 1.22, Rs 0.71 and Rs (0.71).

The market capitalization of MMTC as of yesterday was Rs 21,145 crs which would at the floor price reduce to Rs 6,000 crs. The company as the name suggests is in the business of trading and has in the past done trading in commodities as diverse as gold, iron ore and wheat. At the end of the day it is a trading company and has margins which are as low as 1.07% at the operating level while at the net level they were negative last year and at 0.40% in the previous year. At the floor price of Rs 60 ignoring the EPS for the year ended March 2013 which was negative and considering EPS for March 12 of Rs 0.29 the PE ratio is a staggering 206.89 times.

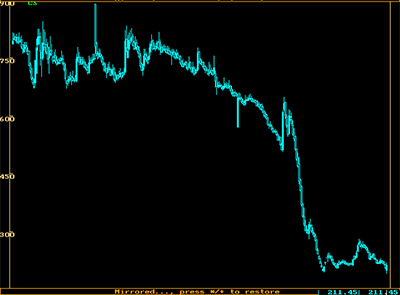

The price chart of the scrip for last 12 months is given below. One can see the value erosion over time where the share has fallen from over Rs 800 to the current price of Rs 211. In the next few days it would adjust to the offer for sale price of Rs 60.

It makes no sense to apply for the share in the OFS even at this steep discount of 71%. The picture at the end of the day would be that LIC and PSU banks would by force have to bail out the issue and complete the divestment objective of the government.