The government which is selling a 12.5% stake in RCF or 689.61 lac shares has fixed the floor price at Rs 45. The closing price of the share as of Thursday end of day on the BSE was Rs 43.85 while it was Rs 43.90 on the NSE. The OFS floor price is fixed at Rs 45 which implies a premium of Rs 1.15 or 2.56% on the BSE close and Rs 1.10 or 2.44% on the NSE close.

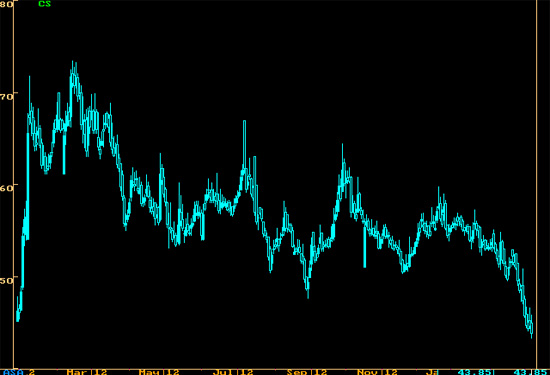

The government would realise approximately Rs 310 crs at the floor price which would see the government’s holding reduce to 80% from the present 92.5%. One wonders why the pricing was done at a premium. The share performance as can be seen from the chart below has been unsatisfactory and the share has been on a broad decline over the last 12 months or so. The share price one month ago was Rs 51.95 while the same at the beginning of the year was Rs 54.55. The high of the share was a little over a year ago on the 14th of February 2012 of Rs 73.45.

The market capitalisation of the company based on the closing price of Rs 43.85 is Rs 2,422 crs. The company which is into the manufacture of fertilisers and chemicals registered a net profit of Rs 248.83 crs or an EPS of Rs 4.51 on a consolidated basis for the year ended March 2012. In the current nine month period ended December 2012, the net profit is Rs 163.38 crs or an EPS of Rs 2.96. The share maybe compared with companies like Chambal Fertilisers, GSFC and also Coromandel Fertilisers. On parameters like operating margins and net margins it appears on the lower side compared to the peer group. Its PE is certainly on the higher side limiting the possibility of making money on the upside.

It may be mentioned that the 52 week high and low for the stock is Rs 68.80 and Rs 43.25 respectively. The low of the share incidentally was made yesterday. Looking at the floor price which has been fixed higher than the current market price it makes no sense to apply in the OFS. If one does want to invest in the share it makes sense to buy from the secondary market only. It appears that the divestment ministry after doing very successful divestments of NMDC and NTPC seems to have got its maths wrong for a small size divestment. It appears that LIC would play a big role in completing this divestment and fetch the government a sum in excess of Rs 310 crs.