During the fag end of the quarter there was a rush of IPO’s from companies who wanted to open their issues and they did so in the last three days of the month. The compelling reason was nothing to do with astrology or the market conditions; it was a regulation of SEBI, which allows IPO’s to open their issues with audited financial results which are not yet six months old. Therefore a company opening its issue on the 30th of September is allowed to do so provided the results forming part of the Red Herring Prospectus have results for the March 2011 period at the bare minimum.

This year we had as many as nine issues coming in the month with eight of them getting subscribed and one issue being unsuccessful. The issue which failed to get through was Swajas Air Charters Limited which had tapped the capital markets with its issue to raise Rs 37.5 crs in a price band of Rs 90-100. The issue having failed to garner support saw the issue being extended, and the price band was therefore reduced to Rs 84-90. The issue got subscribed but it failed to receive the mandatory 50% subscription from QIB’s and had to withdraw the issue.

An issue which was launched in April-May 2011 and got embroiled in all sorts of controversies and sawhistory in the making with the regulator and Securities Appellate Tribunal (SAT) asking it to issue bonus shares to the public shareholders etc., Vaswani Industries listed on the 24th of October.

This bunch of nine issues if analysed as a group have many similarities and make interesting observation. Almost all the issues except one had grades of 1 and 2 indicating poor fundamentals. The second common thing is that all but one issue was ridiculously priced and had valuations which are unheard of in the industry in the relevant sector or the markets as a whole. The third common factor is that 5 out of the 9 issues crashed on day one losing more than 60% of their price on the listing day itself. The fourth factor is that the trading volumes in these shares would put the large cap stocks like Reliance and even an ICICI bank to shame. Some of these issues continue to trade at ridiculous levels and unsustainable valuations as the “friendly” intermediary is unable to exit the stock and this now becomes the long term investment in the stock until and unless he gets someone to agree to bail him out.

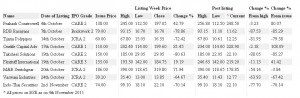

There is therefore a very important question which comes up whether retail investors actually benefit by applying for shares where the fundamentals are extremely poor and the issue is subscribed only with the help of buyback and “friendly” intermediaries. I believe the answer would be available in the table which is available for these nine issues a little later in the article.

Let us analyse a case in point where extremely poor fundamentals existed. The case is of M&B Switchgear which issued shares at a price of Rs 186 and the PE ratio at that price was an audacious 480 times. The price rose further and at the high of Rs 390, the PE ratio was actually in four digits at 1006. Even if one were to look at the business which is proposed, the setting up of a solar power plant of 6 MW which would cost the company Rs 100 crs, the valuation at this price of market capitalisation was a staggering Rs 130 crs per MW or 8.13 times the project cost. One has to believe that there is something which the promoters and merchant bankers knew which common investors did not. It’s a separate issue that post this high of Rs 390, the share has more than halved and closed for trading at Rs 178.85 which is a small discount of 3.84% to the issue price. The price per MW even at this price is Rs 59.6 crs per MW.

In the example of turnover the case of Indo-Thai Securities would be a classic case where on the day of listing the company had a combined turnover of 867.60 lac shares which was 21.69 times the IPO size of 40 lac shares. The turnover was a staggering Rs 517.67 crs on the two exchanges combined and constituted 4.58% of the total turnover of the exchange of Rs 11,300 crs.

From the above table the issues can be broadly categorised into two where one has poor fundamentals and are extremely expensive and those that were reasonably priced and had good fundamentals. It may seem strange but the only issue which had a grade 3 was the most reasonably priced issue. Of the two broad categories where the first had eight issues and the second category a single issue, five issues crashed on day one. The failure ratio was a staggering 62.5%. The extent of fall was anywhere between 65 and 80%. Of the remaining three, two are trading above par and are currently up 80% and 108%. It sure is baffling that with markets being where they are and the condition of the broking industry whether it is the primary market or the secondary market is in such a bad shape why would somebody want to invest in a company like One Life Capital Advisors which has a market capitalisation of Rs 278 crs as of the 4th of November on revenues of 40 lacs for the year ended March 2011 and a net loss of Rs 60 lacs for the period. The PE multiple is infinite and prospects for the industry are a little gloomy currently.

The other company is PrakashConstrowel where the price has been on an upward curve since the day of listing. This is a very small road construction company from Nasik, and the current valuations are not only expensive but raise doubts about the motive behind such a huge price.

The third issue in the first category is M&B Switchgear which is currently trading below the issue price after doubling.

In the second category, there is only one company namely Flexituff International. The company had a grade of 3/5 and was the highest fundamental grade in the nine issues. The stock price has been steadily moving up and is currently trading at a premium of 41% to its issue price. This was the only issue out of the lot of nine issues that this writer had recommended and it is vindication of the kind of analysis that goes into the issue before a recommendation is made.

Let us hope that after these observations and performance, readers and investors would be able to take a call on poor fundamental issues in future and sae themselves from losses and heartburn.