| Exchange | Open | High | Low | Close | Net Change | % gain | Wt Avg | Volume | Delivery | Del % age |

| BSE | 118.55 | 201.90 | 117.00 | 187.95 | 77.95 | 70.86 | 148.50 | 46862627 | 2576818 | 5.50 |

| NSE | 122.00 | 200.00 | 117.00 | 185.35 | 75.35 | 68.50 | 150.13 | 61634263 | 2716349 | 4.41 |

| Total | 108496890 | 5293167 | 4.88 |

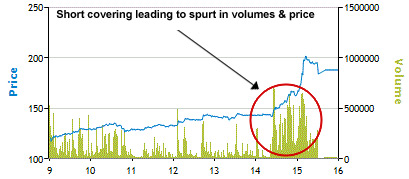

Trading volume which was 2.34 cr shares at the end of the first hour continued its momentum and in the last hour went crazy clocking a turnover of 4.68 crs on the BSE and 6.16 crs on the NSE. The total traded turnover was 10.85 cr shares which is 17.36 times the IPO size of 62.5 lakh shares. The delivery volume was 52.93 lakh shares or a mere 4.88% of traded volume. However as a %age of IPO size it was 84.69%.

Institutions have sold their shares and some of them include names like Somerset Emerging Opportunities Fund, Somerset India Fund, India Max Investment Fund Limited, Deutsche Securities Mauritius Limited and Taib Securities Mauritius Limited. It appears against the institutional and retail selling some corporate and HNI’s have bought shares and these names are available on the BSE and NSE bulk trades segment.

For the share to remain strong and continue to trade at current levels which are fundamentally unjustifiable, the people or entities who have bought yesterday should continue to hold their shares. The current price makes the share extremely expensive and though there has been unexpected movement yesterday, one should not get tempted to buy this share at current levels.