National Fertiliser Limited (NFL) would today see the government selling 374.80 lac shares or 7.64% of the equity of the company at a floor price of Rs 27. The share closed at Rs 26.70 down Rs 3.05 or 10.25% on the BSE. On the NSE the stock price closed at Rs 26.55, down Rs 3.10 or 10.45%.

The floor price is higher than the closing price which makes the offer unattractive in the first place. Secondly the company has made losses this year (12-13) on account of planned shutdown for conversion from oil based to gas based and the same has been completed. This would result in the company returning to profitability in the current financial year. Irrespective of the above, it is expensive on all parameters and it would make better sense to look at RCF.

NFL can be compared with RCF which is another PSU in the same line of activity. The revenues too are quite similar but the profitability seems to be different. While NFL reported revenues of Rs 6,725 crs in 12-13, Rs7,304crs in 11-12 and Rs 5,820.71 crs in 10-11, RCF in the same period reported revenues of Rs 6,894 crs, Rs 6,433 and Rs 5,507 crs. While NFL made a net loss in 12-13 of Rs 170.73 crs it made net profits of Rs 126.73 crs and Rs 138.50 crs in the earlier years. The EPS is (3.48), 2.58 and 2.82 respectively. In the case of RCF the net profits were Rs 280.90 crs, Rs 249.24 crs and Rs 245.12 crs and the EPS 5.09, 4.52 and 4.44. The dividend paid out also is different with NFL not announcing anything this year and paying Rs 0.78 and 0.85 for the previous years while RCF has announced Rs 1.5 for the year 12-13 and paid Rs 1.40 and Rs 1.10 for the previous years.

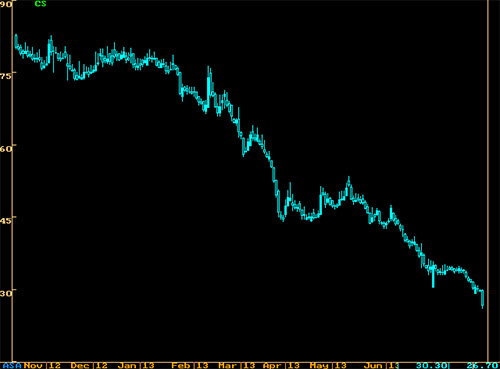

From the above price chart one can see that the share price has been falling one way and from a high of Rs 83 in October 2012 is now under Rs 27. The equity of RCF is higher by 10% when compared with NFL. RCF has an equity of Rs 551.69 crs while NFL’s equity is 490.58 crs. One lesson to remember from the previous divestments or OFS of the government is that no price imaginable is impossible to reach. Almost every share divested has lost significant value. Rest assured NFL will be no exception. Avoid the offer for sale.