India Infrastructure Finance Company Limited (IIFCL) is tapping the capital markets with a bond issue to raise upto Rs 1,200 crs. The issue has opened on the 4th of February and would remain open until the 4th of March 2011.

| Size of Issue | Rs 1,200 crs |

| Face Value of each bond | Rs 1,000 each |

| Book Running Lead Manager | ICICI Securities Limited |

| SBI Capital Markets Limited | |

| A.K.Capital Services Limited | |

| Bajaj Capital Limited | |

| Enam Securities Private Limited | |

| Karvy Investor Services Limited | |

| RR Investors Capital Services (Private) Limited | |

| Yes Bank Limited | |

| Lock in Period | 5 years from deemed date of allotment |

| Trading | After expiry of lock in period at the BSE |

| Isssue Opening Date | Friday 4th February |

| Isssue closing date | Friday 4th March |

| Ratings | AAA/Stable from CRISIL and CARE AAA from CARE |

| Bidding lot size | Minimum of 5 bonds and 1 bond thereafter |

IIFCL is a company wholly owned and promoted by the Government of India. The company was incorporated on the 5th of January 2006, with a paid up capital of Rs 1,000 crs. As of 30th September 2010, the company has cumulative gross loans sanctioned of Rs 27,500 crs, in 154 projects, having a total project cost of Rs 2,31,371 crs. The total disbursement as of 30th September 2010 is Rs 11,133 crs. The company IIFCL has nil NPA’s as of date.

The opportunity and growth in Infrastructure is something which is well known. The revised estimate for investment in infrastructure in the 12th Five year plan is $1025 billion against half of that or $ 514 billion in the 11th Five year plan. This would be roughly 10% of the GDP and private capital is expected to fund 50% of the total investment in the 12th Plan against 30% in the 11th Plan.

Financials

IIFCL had net income from operations of Rs 630 crs in the year ended March 2009, Rs 1,601 crs in the year ended March 2010 and Rs 928 crs in the half year ended September 2010. The net profit for the company was Rs 104 crs for March 2009, Rs 220 crs for March 2010 and Rs 128 crs in the half year ended September 2010.

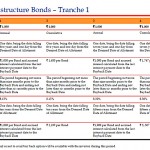

These bonds are in the nature of long term infrastructure bonds in the nature of secured, redeemable, non-convertible debentures having benefits under section 80CCF of the income tax act. The salient features of the bonds are listed below.

The issue is attractive and is at similar to the one being offered by L&T Infrastructure Finance Company Limited. Investors must note that it makes sense to invest upto a maximum of Rs 20,000 per individual as that is the cap on which tax benefits are available. It would be a tossup between IIFCL and L&T.

SEBI Disclaimer: – I have already taken the benefit of section 80CCF in the first round of bonds issued and hence it makes no economic sense for me to apply.