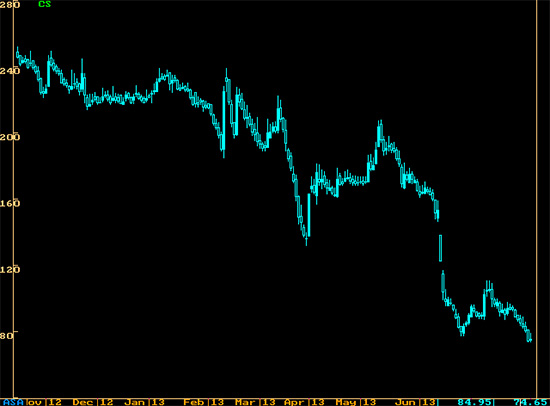

The government is doing an OFS for two companies today. The first is State Trading Corporationwhere a total of 6.13 lac shares would be on offer at a floor price of Rs 74. The share price closed at Rs 74.65 on the BSE with a gain of Rs 0.15 yesterday and was at identical levels on the NSE as well. The share has been on a steady decline and has been falling continuously over the last 10 months. The share traded at Rs 251.90 on 6th October 2012, Rs 208 on the 13th of May 2013, Rs 158.90 on the 12th of June and at Rs 110.50 as recently as the 10th of July.

The revenues of the company have fallen significantly in the previous year at Rs19,275 crs against Rs31,046 crs in the year ended March 2012. The net profit was Rs 17.95 crs in 12-13 against Rs 16.47 crs in 11-12. The EPS for the year is Rs 2.99 against Rs 2.74 last year. The company has maintained the dividend at Rs 2 for the year. The EPS has improved marginally in the year ended March 2013 but has been falling significantly over time with an EPS of Rs 9.41 in 2010-11, Rs 14.05-2009-10 and Rs 13.56 in 2008-09.

The PE based on March 2013 numbers and the offer for sale floor price of Rs 74 is 24.75. The asking price is expensive and leaves nothing for the investor on the table. Though the price is closer to the market price, I believe with the whole market on a discount sale one should avoid the stock.

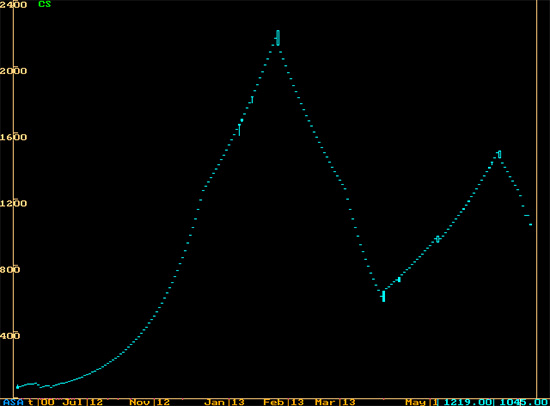

The second divestment is from India Tourism Development Corporation Limited which has fixed the floor price at Rs 70. The government is selling 42.88 lac shares or roughly 5% of the company’s equity. The share is traded in the periodic call auction mechanism and the last traded price on the BSE was Rs 1045 on the BSE. The floor price of Rs 70 means that the minimum price is a mere 6.69% of the last traded price.

From the above chart one can see that the share made a high of Rs 2,218 in February 2013 and has been on a downward trend since then. It fell to a low of Rs 585 in April 2013 and has since then recovered some of the losses and closed at Rs 1,045 yesterday. The catch is the volume in the periodic call auction where in the last 10 trading sessions the cumulative volume has been a mere 56 shares and on as many as 4 days there was a single share traded. It may also be mentioned that the 10 trading sessions are spread over 7 weeks.

Coming to the financials of the company the revenues for the year ended March 2013 were just about Rs 400 crs, with a net profit of Rs 18.88 crs and an EPS of Rs 2.20. In the previous year the revenues were almost similar at Rs 397 crs but the net profit was substantially lower at Rs 8.53 crs and the EPS a mere Rs 1. The company had declared a dividend of Rs 0.50 for the year ended March 2012 and has yet to declare a dividend for the current year.

The share is being offered at a floor price of Rs 70 which translates into a PE of 31.81 times. It is upto an individual to decide what opportunity this share could offer which is traded in the periodic call auction and is offered at 32 multiples.

The government is also through a qualified placement offering shares of Neyveli Lignite in a price band of Rs 58-60 against the closing price of Rs 55.70. The government of Tamil Nadu through its state corporations is expected to subscribe to the above offer.

As far as retail investors are concerned they would do well to stay away from the above two offers as it has no visible returns in even the medium term.